Understanding Current Yield vs. Yield to Maturity Understanding Current Yield...

Read MoreBond Yield Vs Interest Rates

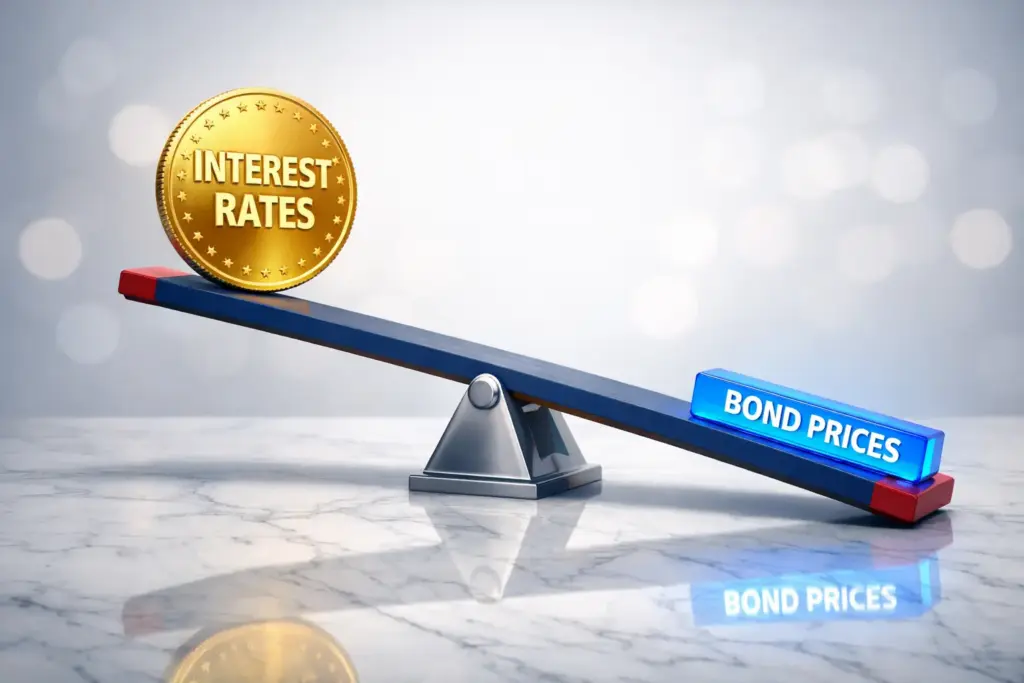

Understanding the Relationship Between Bond Yields and Interest Rates

As a cornerstone of the global financial system, the interplay between bond yields and interest rates dictates the flow of capital, influences corporate borrowing, and shapes investor portfolios. For investors navigating the diverse investment services offered in the UAE and international markets, mastering this inverse relationship is essential for effective risk management and capital preservation.

Table of Contents

- How Do Interest Rates Influence Bond Prices and Yields?

- What Is the Difference Between a Bond’s Coupon Rate and Its Yield?

- Why Do Bond Yields Move Inversely to Interest Rates?

- How Does Inflation Impact the Bond Yield-Interest Rate Dynamic?

- What Should Investors Consider When Rates Are Rising?

- Conclusion: Strategic Fixed-Income Positioning

How Do Interest Rates Influence Bond Prices and Yields?

The relationship between interest rates and bond prices is fundamentally inverse. When central banks—such as the Federal Reserve or the Central Bank of the UAE—adjust benchmark interest rates, they effectively reset the “cost of money” for the entire economy.

When interest rates rise, newly issued bonds enter the market offering higher coupon payments to attract investors. Consequently, existing bonds with lower fixed coupons become less attractive. To entice buyers, the market price of these older bonds must drop. Conversely, when interest rates fall, existing bonds with higher fixed coupons become highly sought after, driving their market prices upward.

Yield, in its simplest form, represents the return an investor realizes on a bond. As the price of a bond falls, its yield rises (because the fixed interest payment now represents a larger percentage of the discounted purchase price). Understanding this mechanism is vital when reviewing your multi-asset portfolio performance, as it explains why fixed-income valuations may fluctuate despite stable interest payments.

What Is the Difference Between a Bond’s Coupon Rate and Its Yield?

It is a common misconception among retail investors that a bond’s coupon and its yield are the same. The coupon rate is the fixed annual interest payment established when the bond is issued, expressed as a percentage of the face value.

The bond yield, specifically the “Yield to Maturity” (YTM), is a more dynamic metric. It accounts for the coupon rate, the current market price, and the time remaining until maturity. If you purchase a bond at a “premium” (above face value), your yield will be lower than the coupon rate. If purchased at a “discount” (below face value), your yield will be higher.

For those engaging in global wealth management, distinguishing between these two is critical. The coupon provides the cash flow, but the yield tells the true story of the investment’s total return potential in the current economic climate.

Enhance Your Fixed-Income Strategy

Access institutional-grade bond market insights today.

Why Do Bond Yields Move Inversely to Interest Rates?

The inverse movement is driven by the concept of “Opportunity Cost.” Imagine you hold a bond paying 3% interest. If the central bank raises interest rates, new bonds might start paying 5%. No rational investor would buy your 3% bond at face value when they can get 5% elsewhere.

To sell your 3% bond, you must lower the price until the total return (the 3% coupon plus the capital gain when the bond matures at full face value) equals the current market rate of 5%. This “price adjustment” is what causes the yield to climb as rates rise. This phenomenon is a primary driver of volatility in fixed income trading, requiring active duration management to protect against interest rate shocks.

How Does Inflation Impact the Bond Yield-Interest Rate Dynamic?

Inflation is the silent predator of fixed-income returns. When inflation rises, the purchasing power of a bond’s fixed future payments diminishes. To compensate for this loss of value, investors demand higher yields, which exerts upward pressure on interest rates.

Central banks typically respond to high inflation by raising interest rates to cool the economy. This creates a “double-whammy” for bondholders: prices fall due to rising rates, and the real value of the coupons falls due to inflation. Professional investors often look toward diversified investment funds that include inflation-protected securities or shorter-duration assets to mitigate these specific risks during inflationary cycles.

What Should Investors Consider When Rates Are Rising?

In a rising rate environment, “duration” becomes the most important metric. Duration measures a bond’s sensitivity to interest rate changes. Bonds with longer maturities generally have higher duration, meaning their prices will fall more sharply when rates rise.

Investors should consider a “laddering” strategy—staggering the maturities of their bond holdings. As shorter-term bonds mature, the principal can be reinvested into new bonds at higher current interest rates. This proactive approach to asset management ensures that the portfolio is not locked into low yields for an extended period, allowing the investor to benefit from the changing interest rate landscape.

Optimize Your Global Portfolio

Tailored capital market solutions for professional investors.

Conclusion: Strategic Fixed-Income Positioning

The relationship between bond yields and interest rates is a fundamental pillar of finance that every serious investor must respect. While the inverse correlation between price and yield can introduce volatility, it also creates opportunities for those who understand market cycles.

By distinguishing between coupon rates and yields, monitoring inflationary trends, and managing portfolio duration, investors can navigate fluctuating rate environments with confidence. At PhillipCapital DIFC, we provide the expertise and financial brokerage services necessary to help you interpret these market signals and align your fixed-income strategy with your long-term capital goals.

Frequently Asked Questions (FAQs)

When market interest rates rise, new bonds are issued with higher coupons. This makes existing bonds with lower rates less attractive. To sell these older bonds, owners must lower their price until the total return matches the current market rates.

Not necessarily. While a higher yield means more potential return, it often signals higher risk—such as the issuer’s creditworthiness or rising inflation. Additionally, if yields are rising because bond prices are crashing, current holders may see significant capital losses on paper.

If you hold an individual bond to maturity, market fluctuations generally don’t impact your final payout. You will receive the fixed coupon payments and your full principal back, provided the issuer doesn’t default. Rates only affect you if you try to sell the bond early.

A bond’s yield (Yield to Maturity) accounts for the price paid and interest earned until the end. Annual Percentage Yield (APY) is a standardized way to express the return that includes the effect of compounding interest over a year, making it easier to compare against savings accounts.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Bond Yield Vs Interest Rates

Bond Yield Vs Interest Rates Understanding the Relationship Between Bond...

Read MoreBond Yield to Maturity (YTM)

Bond Yield to Maturity (YTM): Understanding Bond Yield to Maturity...

Read MoreCalculating Bond Price And Yield

Calculating Bond Price And Yield Understanding Bond Valuation: A Comprehensive...

Read MoreBond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreInvestment Grade vs Non-Investment Grade Bonds

Investment Grade vs Non-Investment Grade Bonds A Guide for UAE...

Read MoreBonds: Face Value, Par Value & Coupon Rate

Bonds: Face Value, Par Value & Coupon Rate When venturing...

Read MoreBond Issuers Government vs Corporate Bonds

Bond Issuers Government vs Corporate Bonds What UAE Investors Need...

Read MoreUnderstanding Bond Fundamentals: A Guide for Smart Investing

Understanding Bond Fundamentals: A Guide for Smart Investing In the...

Read More