Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreBond Maturities

Short-Term, Intermediate, and Long-Term Bonds

Table of Contents

What Are Bond Maturities and Why Do They Matter?

In the world of fixed-income investing, maturity is more than just a date on a calendar; it is the primary driver of a bond’s risk profile and potential return. When you purchase a bond, you are essentially lending capital to an issuer—be it a government or a corporation—for a specific period. The “maturity date” is the deadline by which that issuer must repay your principal investment.

Understanding maturity is crucial because it dictates how sensitive your investment is to interest rate fluctuations and inflation. A well-structured fixed income portfolio often utilizes a mix of maturities to smooth out volatility. Whether you are preserving wealth through sovereign debt or seeking higher yields in the corporate sector, the timeline of your bond investment defines your liquidity and expected cash flow.

What Defines a Short-Term Bond?

Short-term bonds are generally defined as debt securities with maturities ranging from one to three years. These instruments are often favored by conservative investors or those managing near-term liquidity needs. Because the capital is tied up for a relatively brief period, the risk of default and the impact of interest rate changes are significantly lower compared to longer-dated securities.

Key Characteristics:

- Lower Volatility: Short-term bonds are less sensitive to interest rate hikes. If rates rise, the price of a short-term bond drops less than that of a long-term bond.

- High Liquidity: These assets can often be converted to cash quickly with minimal price impact, making them a staple in wealth management strategies for holding operating cash.

- Modest Yields: In exchange for safety and liquidity, investors typically accept lower yields compared to longer-term options.

Who is this for?

Short-term bonds are ideal for investors who need to access their funds in the near future or those who wish to “park” capital safely while waiting for market volatility to settle.

Secure Your Liquidity Explore Short-Term Opportunities

Discover stable, high-quality fixed-income assets tailored for capital preservation.

How Do Intermediate-Term Bonds Balance Risk and Reward?

Intermediate-term bonds typically have maturities between three and ten years. They serve as the “middle ground” in a portfolio, offering a compelling compromise between the low yields of short-term debt and the high volatility of long-term debt.

For many sophisticated investors, this category represents the core of a diversified income strategy. Intermediate bonds usually capture a significant portion of the yield available in the market without exposing the investor to extreme duration risk. If interest rates rise, these bonds will experience moderate price fluctuations, but the higher coupon payments can help cushion the blow over time.

Investors utilizing our global markets trading platforms often allocate to intermediate treasuries or investment-grade corporate bonds to anchor their portfolios. This “laddering” approach allows them to lock in respectable rates while maintaining a degree of flexibility.

When Should Investors Consider Long-Term Bonds?

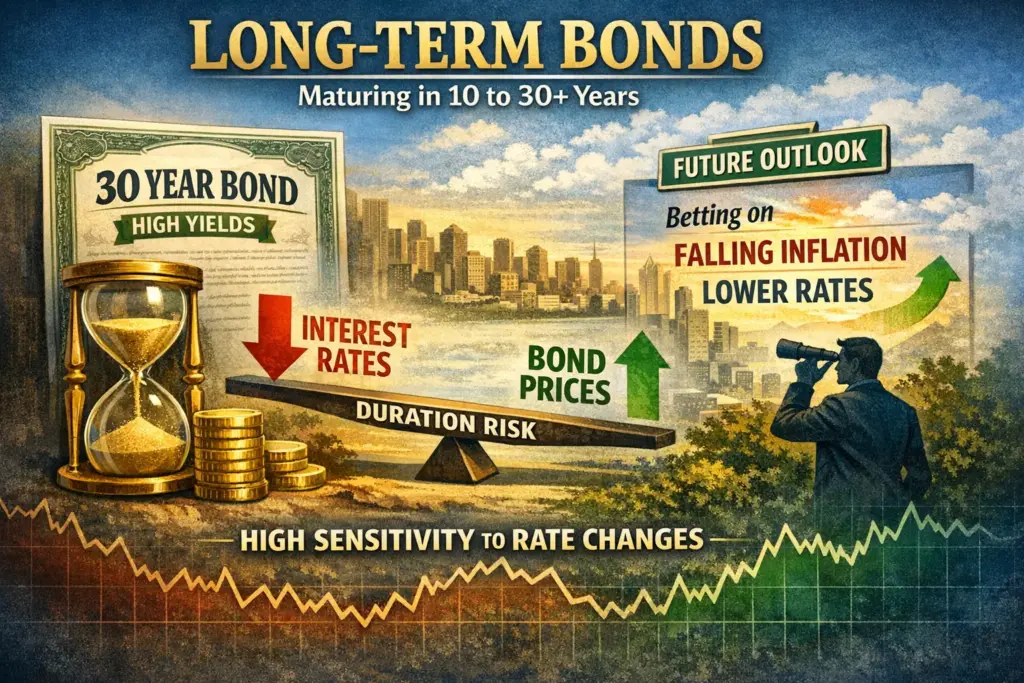

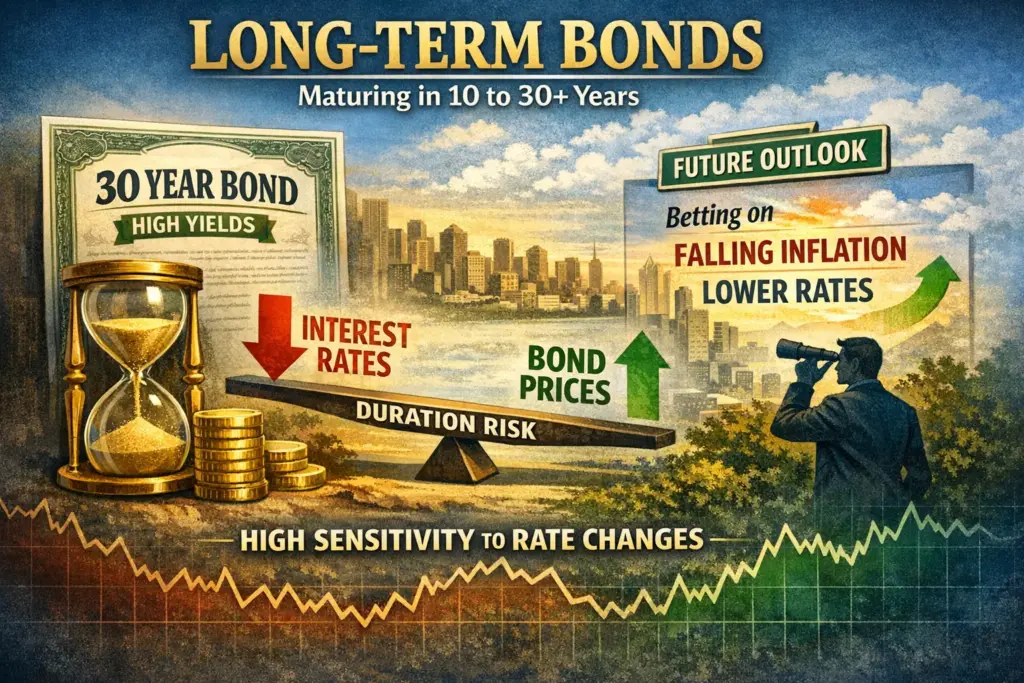

Long-term bonds are securities that mature in 10 to 30 years (or more). These are the heavyweights of the fixed-income world, offering the highest potential yields to compensate investors for locking away their capital for decades.

The Duration Factor: The defining feature of long-term bonds is their high duration. Duration measures a bond’s sensitivity to interest rate changes. A 30-year bond will see its price swing dramatically if interest rates move even a small amount. This makes long-term bonds a tool for investors with a strong conviction about the future direction of the economy—specifically, those who believe inflation and interest rates will decline.

The Role in a Portfolio: While volatile, long-term bonds often have a low correlation with equities. During periods of economic deflation or recession, when stock markets may struggle, high-quality long-term government bonds often rally, providing a critical hedge. Accessing these specific durations requires a robust partner capable of navigating complex global bond markets.

Optimize Your Yield Plan for Long-Term Growth

Access premium long-term sovereign and corporate bonds to boost your portfolio yield.

How Does the Yield Curve Impact Bond Maturity Choices?

The yield curve is a graphical representation of the interest rates on debt for a range of maturities. In a healthy economy, the curve slopes upward, meaning long-term bonds yield more than short-term bonds. This “term premium” rewards investors for the risk of holding debt over time.

However, the shape of the curve changes.

- Steep Curve: Suggests rapid economic growth; long-term bonds offer much higher yields.

- Flat Curve: Suggests uncertainty; yields are similar across maturities.

- Inverted Curve: Occurs when short-term rates are higher than long-term rates, historically a signal of an impending recession.

Monitoring the yield curve is essential for tactical asset allocation. For instance, if the curve is inverted, an investor might prefer structured investment solutions or short-term notes rather than locking in lower rates for the long haul.

Which Bond Duration Fits Your Investment Portfolio?

Selecting the right maturity is not a binary choice; it is a strategic decision based on your financial horizon and risk tolerance.

- For Capital Preservation: If your goal is to protect principal for a purchase in the next 12-24 months, focus on short-term government securities.

- For Income Generation: If you need a steady income stream to fund living expenses or other liabilities, an intermediate-term ladder provides a reliable blend of yield and stability.

- For Aggressive Total Return: If you are managing a long-horizon fund or family office capital and anticipate a drop in interest rates, long-term bonds offer significant capital appreciation potential.

Investors should also consider the tax implications and currency exposure when trading international debt. Utilizing institutional brokerage services can provide the necessary access to diverse markets, ensuring that your duration strategy is executed efficiently across different jurisdictions.

Conclusion

The distinction between short-term, intermediate, and long-term bonds lies at the heart of successful fixed-income investing. Short-term bonds offer safety and liquidity; intermediate bonds provide a balanced risk-reward profile; and long-term bonds offer maximum yield potential and hedging capabilities against deflation.

Navigating these maturities requires more than just intuition—it demands access to real-time data, global liquidity, and expert execution. Whether you are constructing a laddered portfolio or speculating on interest rate movements, aligning your bond selection with your broader financial goals is paramount.

Frequently Asked Questions (FAQs)

For most beginners, short-term bonds (1-3 years) are the safest starting point. They offer lower volatility and higher liquidity, meaning your investment value won’t swing wildly if the market changes. They act as a stable “parking spot” for cash while you learn the ropes of fixed-income investing.

Mostly, yes—but only regarding price risk. If you hold an individual bond until it matures, you will receive the full principal back (barring default), regardless of daily price fluctuations. However, you still face inflation risk—the chance that the fixed money you get back won’t buy as much as it did when you first invested.

Investors buy long-term bonds to lock in a specific yield for decades. Even if rates rise later, a long-term investor might prefer the certainty of a guaranteed 4% or 5% payout for 30 years over the risk of reinvesting short-term bonds at potentially lower rates in the future.

Not necessarily. While the price of the fund may drop temporarily when rates rise, the fund will eventually reinvest its capital into newer bonds with higher yields. Over time, these higher interest payments can offset the initial drop in price. Selling in panic locks in your losses, whereas holding often allows the higher yield to recover the value.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Investment Grade vs Non-Investment Grade Bonds

Investment Grade vs Non-Investment Grade Bonds A Guide for UAE...

Read MoreBonds: Face Value, Par Value & Coupon Rate

Bonds: Face Value, Par Value & Coupon Rate When venturing...

Read MoreBond Issuers Government vs Corporate Bonds

Bond Issuers Government vs Corporate Bonds What UAE Investors Need...

Read MoreUnderstanding Bond Fundamentals: A Guide for Smart Investing

Understanding Bond Fundamentals: A Guide for Smart Investing In the...

Read More