Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreHow Structured Products Work

A Complete Guide for Investors

Table of Contents

- What Is a Structured Product and How Is It Created?

- What Are the Key Components of a Structured Note?

- How Do Structured Products Protect Capital or Enhance Yields?

- What Are the Most Common Types of Structured Products?

- What Are the Main Risks Investors Should Be Aware Of?

- Who Should Invest in Structured Products?

- Conclusion

What Is a Structured Product and How Is It Created?

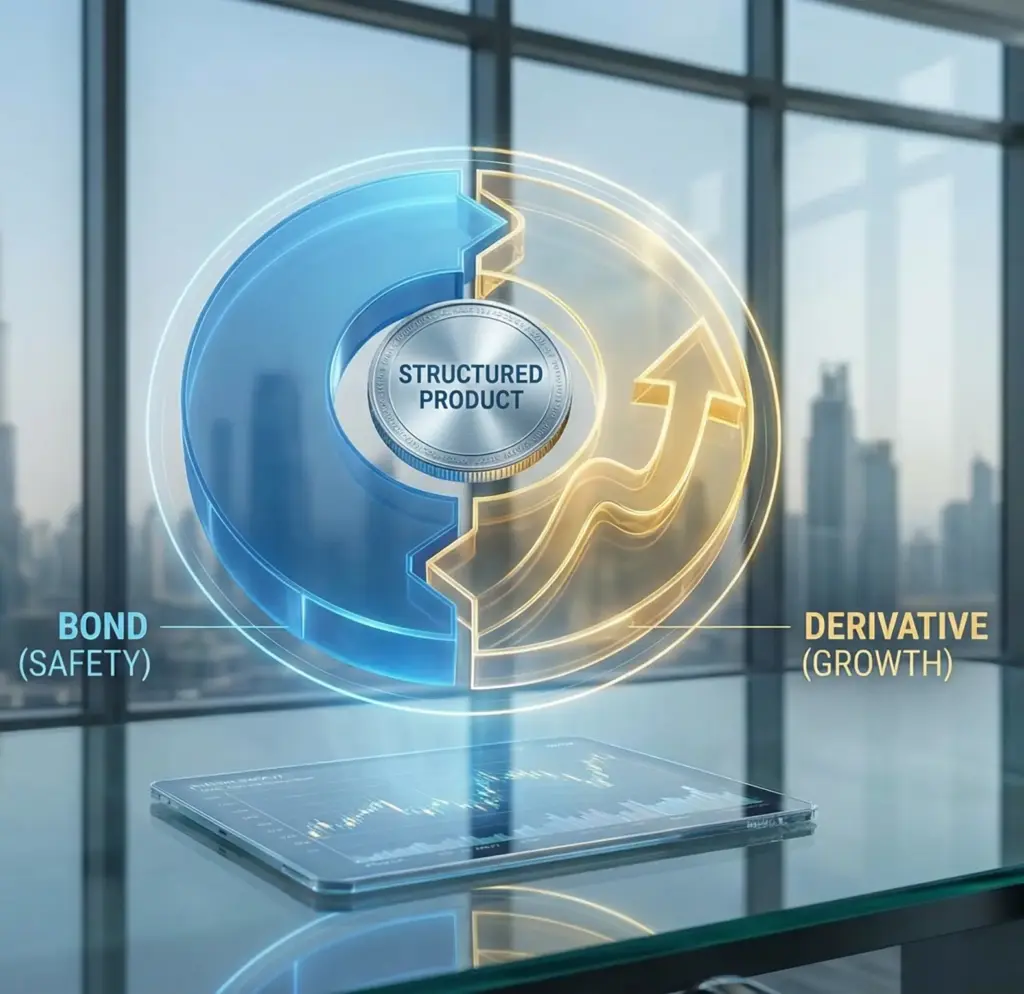

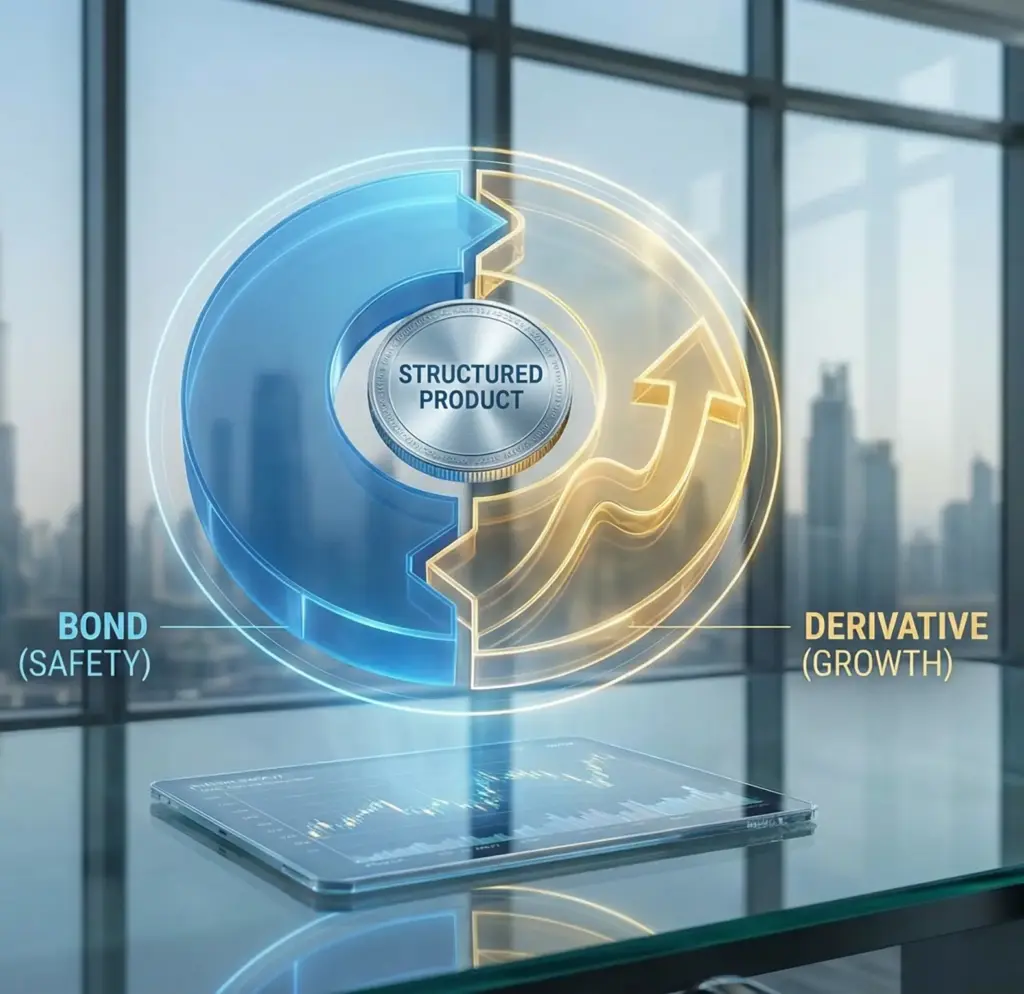

A structured product is a pre-packaged investment strategy that typically combines two distinct financial instruments into a single unit. Unlike buying a standard stock or bond, where your returns are directly tied to the asset’s price movement, a structured product essentially “engineers” a specific risk-return payoff.

These products are created by investment banks to meet specific investor needs that traditional markets cannot satisfy alone. For example, an investor might want the growth potential of the S&P 500 but with the safety of a government bond. To achieve this, the issuer combines a zero-coupon bond (for capital protection) with an option component (for market participation).

By customizing these elements, issuers can create products that offer capital protection, yield enhancement, or access to hard-to-reach asset classes. For a foundational understanding of these instruments and how we approach them at Phillip Capital, you can review our introduction to structured products.

What Are the Key Components of a Structured Note?

To understand how these products work, it helps to deconstruct them into their two primary “building blocks.”

- The Note (Debt Component): This is the “safe” part of the structure. It is essentially a bond issued by a financial institution. Its primary job is to protect your principal. In a capital-protected product, the issuer invests a large portion of your capital (e.g., 80-90%) into a zero-coupon bond that will mature at the full face value of your investment after a set period.

- The Derivative (Investment Component): The remaining capital is used to purchase a derivative, such as a call or put option. This component is linked to an “underlying asset”—which could be a single stock, a basket of equities, an index like the Nasdaq, or even a currency pair. Understanding what derivatives are and their purpose is crucial, as the performance of this specific component determines the “extra” return or coupon you receive.

By adjusting the ratio between the note and the derivative, issuers can tailor the product to be conservative (more bond, less option) or aggressive (less bond, more option).

Designed for Your Financial Objectives

Get access to global structured notes designed for your risk profile.

How Do Structured Products Protect Capital or Enhance Yields?

The “magic” of structured products lies in their ability to reshape risk. They typically fall into two main strategic goals:

- Capital Protection: In uncertain markets, investors prioritize safety. A capital-protected note guarantees the return of 100% (or a partial percentage) of your initial investment at maturity, provided the issuer remains solvent. Even if the stock market crashes, your principal is safe because it is secured by the bond component. If the market rises, you participate in the gains through the option component. This allows conservative investors to gain exposure to volatile assets like US Equities & ETFs while strictly managing their downside risk.

Yield Enhancement: In low-interest-rate environments, traditional bonds may offer unattractive returns. Yield enhancement products, such as Reverse Convertibles, offer significantly higher coupon payments (e.g., 8-12% p.a.). The trade-off is that you take on more risk; if the underlying asset falls below a certain “barrier” level, your capital may be at risk

What Are the Most Common Types of Structured Products?

While the possibilities are endless, most structured products in the UAE market fall into a few popular categories:

- Principal Protected Notes (PPNs): Ideal for conservative investors who want exposure to markets like Gold or the S&P 500 without risking their initial capital.

- Autocallables: These are very popular for generating income. The product has set observation dates. If the underlying asset is above a certain level on that date, the product “automatically calls” (matures early), paying you your capital plus a predefined bonus coupon.

- Reverse Convertibles: These pay a high fixed coupon regardless of market movement, but your principal repayment depends on the asset not falling below a specific “knock-in” barrier.

- Participation Notes: These offer 1:1 exposure to an asset (like a foreign index) but without the need for complex foreign exchange accounts or international brokerage setups. You can even structure notes around commodities; checking our available DGCX products can give you an idea of how gold and other local commodities are traded.

What Are the Main Risks Investors Should Be Aware Of?

Despite their benefits, structured products are not risk-free. It is vital to look beyond the headline return:

- Credit Risk: This is the most critical risk. When you buy a structured note, you are essentially lending money to the issuing bank (e.g., Goldman Sachs, JP Morgan, or similar). If that bank goes bankrupt, you could lose your entire investment, even if the “underlying asset” performed well.

- Liquidity Risk: These products are designed to be held until maturity (e.g., 1 to 5 years). While a secondary market often exists, selling early might result in selling at a discount.

- Market Risk: In yield enhancement products, if the barrier is breached (e.g., the stock drops by 40%), you may lose capital.

- Complexity: The terms can be complicated. For those who prefer more liquid, transparent trading options without lock-in periods or complex barriers, exchange-traded futures and options might be a more suitable alternative.

Navigate Risks with Confidence

Expert guidance to help you choose the right issuer with confidence.

Who Should Invest in Structured Products?

Structured products are generally best suited for Sophisticated or Professional Investors who have a clear view of the market and want to express it precisely.

- The “Range-Bound” Investor: If you think the market will stay flat, a standard stock purchase won’t make money. A structured note can pay a coupon even in a flat market.

- The “Nervous Bull”: If you think the market will go up but fear a crash, a capital-protected note allows you to sleep well at night while still staying invested.

- The Diversifier: Investors looking to access niche markets—such as specific currency pairs or foreign sectors—can do so easily via a note. However, active traders who prefer short-term speculation on currency movements rather than holding long-term notes may find our Spot FX & CFD trading services offer the necessary liquidity and speed.

Conclusion

Structured products offer a powerful toolkit for bridging the gap between standard equity investing and fixed income safety. They allow you to customize your investment journey, offering defined returns and tailored protection levels that off-the-shelf products cannot match. However, they require a nuanced understanding of derivatives and credit risk.

At Phillip Capital DIFC, we leverage our global network to source competitive structured notes from top-tier investment banks, ensuring our clients receive transparent pricing and best-in-class execution. Whether you are seeking to protect your capital or enhance your portfolio’s yield, understanding the mechanics of these instruments is the first step toward smarter investing.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Sector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read MoreHow Structured Products Work

How Structured Products Work A Complete Guide for Investors Table...

Read MoreStock Valuation Methods

Stock Valuation Methods A Comprehensive Guide to Estimating Fair Value...

Read MoreMinor and Exotic Currency Pairs

Minor and Exotic Currency Pairs A Trader’s Guide to Global...

Read MoreLong vs Short Positions in Derivatives

Long vs Short Positions in Derivatives A Complete Guide for...

Read MoreInvestment Grade vs Non-Investment Grade Bonds

Investment Grade vs Non-Investment Grade Bonds A Guide for UAE...

Read MoreStock Market Hours and Session Trading

Stock Market Hours and Session Trading A Global Guide for...

Read MoreOver-the-Counter (OTC) vs Exchange-Traded Derivatives

Over-the-Counter (OTC) vs Exchange-Traded Derivatives A Complete Guide for UAE...

Read MoreBonds: Face Value, Par Value & Coupon Rate

Bonds: Face Value, Par Value & Coupon Rate When venturing...

Read MoreGrowth Investing

Growth Investing The High-Risk, High-Reward Strategy for UAE Investors Growth...

Read MoreComponents of Structured Products

Components of Structured Products A Detailed Guide for UAE Investors...

Read MoreInitial Public Offering Process guide

IPO (Initial Public Offering) Process From Private to Public In...

Read MoreForex Market Structure and Hours

Forex Market Structure and Hours The Complete Guide for UAE...

Read MoreTypes of Derivatives: Futures, Options, Swaps, and Forwards

Types of Derivatives Futures, Options, Swaps, and Forwards In the...

Read MoreBond Issuers Government vs Corporate Bonds

Bond Issuers Government vs Corporate Bonds What UAE Investors Need...

Read MoreWhat Are Equities and Shares

Demystifying the Market What Are Equities and Shares? The world...

Read MoreWhat is Spot FX Trading and How Does It Work?

Decoding the Market What is Spot FX Trading and How...

Read MoreWhat are Derivatives and Their Purpose

What are Derivatives and Their Purpose The financial world is...

Read MoreIntroduction to Stock Markets

Master the Basics: An Introduction to Stock Markets and Deliverable...

Read MoreIntroduction to the Forex Market

Introduction to the Forex Market : Your Gateway to Global...

Read MoreEssentials of Derivatives Trading

Mastering Market Moves: The Essentials of Derivatives Trading The financial...

Read MoreUnderstanding Bond Fundamentals: A Guide for Smart Investing

Understanding Bond Fundamentals: A Guide for Smart Investing In the...

Read More