Futures Fundamentals A Strategic Guide to Capital Markets Table of...

Read MoreNotional Value vs Market Value

Table of Contents

- What Is Notional Value in Financial Markets?

- How Does Market Value Differ from Notional Value?

- Why Is the Distinction Critical for Leveraged Trading?

- How Are Notional and Market Values Calculated in Derivatives?

* Calculating Value in Futures Contracts

* Understanding Options Valuations - When Should Investors Focus on Notional Over Market Value?

- Conclusion

What Is Notional Value in Financial Markets?

In the realm of institutional and professional trading, “price” is rarely a singular concept. Notional value (often referred to as notional amount or nominal value) represents the total underlying value of a financial asset that a contract controls. It is a theoretical value used primarily to calculate payments, interest rates, and leverage ratios, rather than the immediate cash amount required to enter a trade.

For investors utilizing global futures and options, notional value is the metric that defines the true scale of market exposure. For instance, when you trade a commodities futures contract, the initial margin you deposit might be small, but the notional value reflects the total worth of the commodities (e.g., 1,000 barrels of oil) controlled by that contract. Understanding this figure is essential for assessing the true depth of a portfolio’s exposure to market volatility.

How Does Market Value Differ from Notional Value?

While notional value represents the total assets controlled, market value is the actual current price at which a security, derivative, or portfolio can be bought or sold in the open market. It is the figure most investors see on their daily statements—the “mark-to-market” price that fluctuates second-by-second based on supply, demand, and liquidity.

For a standard equity investor buying global stocks, the notional value and market value are typically identical; if you buy $10,000 worth of Apple stock, both values are $10,000. However, the divergence appears in derivatives. In a leveraged position, the market value usually refers to the cost of the contract itself (the premium or the margin equity), which is often a fraction of the notional value. This distinction is vital for capital efficiency, as it dictates how much capital is actually tied up versus how much risk is being taken.

Why Is the Distinction Critical for Leveraged Trading?

The gap between notional and market value is the essence of leverage. Professional traders use this gap to amplify returns, but it effectively amplifies risk as well. If an investor focuses solely on the market value (the cash utilized), they may underestimate the magnitude of a potential loss.

Risk management protocols at top-tier brokerage firms often stress-test portfolios based on notional value. For example, a movement of 1% in the underlying asset price affects the investor based on the notional value, not the cash invested. Investors trading CFDs and Spot FX must remain acutely aware that while their deposited margin (market value of equity) might be low, their notional exposure to currency fluctuations remains at the full contract size.

Optimize Your Capital Efficiency

Access global markets with competitive leverage and institutional-grade support.

How Are Notional and Market Values Calculated in Derivatives?

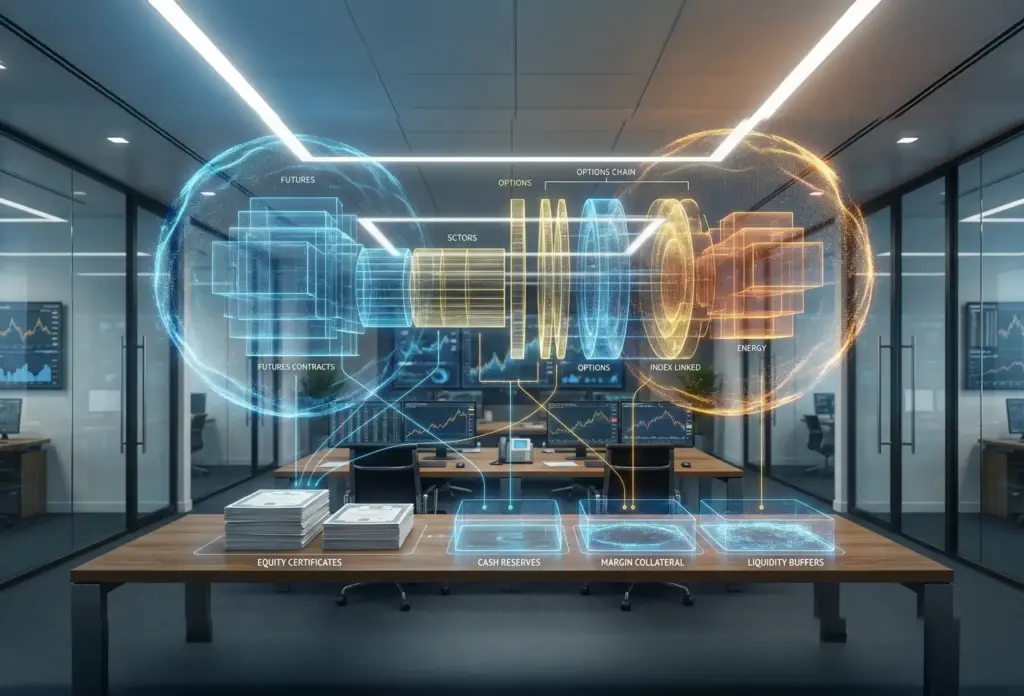

The calculation methods vary depending on the instrument, but the principle remains: one measures exposure, the other measures cost.

Calculating Value in Futures Contracts

In futures trading, the notional value is calculated by multiplying the contract size by the current price of the underlying asset.

- Formula: Notional Value = Contract Size × Current Underlying Price

- Example: If the S&P 500 futures contract has a multiplier of $50 and the index is at 4,000, the notional value is $200,000. The market value of the position to the trader, however, is initially zero (at par) or represented by the margin requirement, adjusting daily as the contract gains or loses value.

Understanding Options Valuations

Options introduce a layer of complexity.

- Notional Value: Typically the Strike Price × Number of Shares × Number of Contracts. This represents the value of the stock if the option were exercised.

- Market Value: This is the premium paid to buy the option.

For investors using hedging strategies with options, distinguishing these values is paramount. A put option might cost only $500 (market value), but it could be hedging a portfolio with a notional value of $50,000.

When Should Investors Focus on Notional Over Market Value?

Sophisticated investors and asset managers prioritize notional value in specific scenarios:

- Asset Allocation: When determining if a portfolio is overweight in a specific sector (e.g., Technology or Energy), one should look at the notional exposure of derivatives, not just the premium paid.

- Hedge Ratios: To effectively hedge a physical stock portfolio using DGCX Futures or other derivatives, the notional value of the hedge must match the market value of the physical assets.

- Regulatory Compliance: Institutional clients and family offices operating under strict mandates often have caps on gross notional exposure to limit systemic risk.

Conversely, market value is the primary focus for liquidity management, ensuring there is enough cash on hand to meet margin calls or fund new opportunities in structured notes and yield-enhancing products.

Professional Portfolio Management

Get expert guidance on managing exposure and risk

Conclusion

Mastering the dynamics between notional value and market value is a hallmark of an advanced investor. While market value dictates the immediate financial health of an account, notional value reveals the true footprint of your investment strategy in the global marketplace. Whether you are trading deliverable equities or navigating complex derivatives, keeping a vigilant eye on both metrics ensures a balanced approach to risk and reward.

At PhillipCapital DIFC, we provide the robust platforms and analytical tools necessary to monitor these values in real-time, empowering you to make data-driven decisions across asset classes.

Frequently Asked Questions (FAQs)

This significant difference exists primarily due to leverage. In derivatives trading (like futures or CFDs), you are only required to deposit a fraction of the total trade size (the margin) to open a position. While the market value reflects this smaller cash outlay or the current trading price of the contract, the notional value represents the total worth of the assets you effectively control.

It depends on the financial instrument. For stocks, commissions are typically based on the market value (the actual transaction amount) or a flat fee per share. However, for CFDs and FX, financing fees (swaps) are often calculated based on the notional value of the position, since the broker is effectively lending you the capital to control the full asset size. Always check your broker’s fee schedule to confirm.

Not necessarily, but it indicates the scale of your risk. If you buy a standard stock (cash equity), the notional value is the most you can lose (if the stock goes to zero). However, in leveraged futures or short selling, your potential losses are tied to the notional exposure and can theoretically exceed your initial deposit (market value), making risk management tools like Stop Losses essential.

You can calculate this by multiplying the strike price by the contract multiplier (usually 100 shares for standard equity options) and then by the number of contracts.

- Formula: Strike Price × Multiplier × Number of Contracts = Notional Value.

Note: Do not confuse this with the “premium,” which is the market cost to buy the option

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Bond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read MoreHow Structured Products Work

How Structured Products Work A Complete Guide for Investors Table...

Read MoreStock Valuation Methods

Stock Valuation Methods A Comprehensive Guide to Estimating Fair Value...

Read MoreMinor and Exotic Currency Pairs

Minor and Exotic Currency Pairs A Trader’s Guide to Global...

Read MoreLong vs Short Positions in Derivatives

Long vs Short Positions in Derivatives A Complete Guide for...

Read MoreInvestment Grade vs Non-Investment Grade Bonds

Investment Grade vs Non-Investment Grade Bonds A Guide for UAE...

Read MoreStock Market Hours and Session Trading

Stock Market Hours and Session Trading A Global Guide for...

Read MoreOver-the-Counter (OTC) vs Exchange-Traded Derivatives

Over-the-Counter (OTC) vs Exchange-Traded Derivatives A Complete Guide for UAE...

Read MoreBonds: Face Value, Par Value & Coupon Rate

Bonds: Face Value, Par Value & Coupon Rate When venturing...

Read MoreGrowth Investing

Growth Investing The High-Risk, High-Reward Strategy for UAE Investors Growth...

Read MoreComponents of Structured Products

Components of Structured Products A Detailed Guide for UAE Investors...

Read MoreInitial Public Offering Process guide

IPO (Initial Public Offering) Process From Private to Public In...

Read MoreForex Market Structure and Hours

Forex Market Structure and Hours The Complete Guide for UAE...

Read MoreTypes of Derivatives: Futures, Options, Swaps, and Forwards

Types of Derivatives Futures, Options, Swaps, and Forwards In the...

Read MoreBond Issuers Government vs Corporate Bonds

Bond Issuers Government vs Corporate Bonds What UAE Investors Need...

Read MoreWhat Are Equities and Shares

Demystifying the Market What Are Equities and Shares? The world...

Read MoreWhat is Spot FX Trading and How Does It Work?

Decoding the Market What is Spot FX Trading and How...

Read MoreWhat are Derivatives and Their Purpose

What are Derivatives and Their Purpose The financial world is...

Read MoreIntroduction to Stock Markets

Master the Basics: An Introduction to Stock Markets and Deliverable...

Read MoreIntroduction to the Forex Market

Introduction to the Forex Market : Your Gateway to Global...

Read More