Futures Fundamentals A Strategic Guide to Capital Markets Table of...

Read MorePrice-to-Earnings Ratio (P/E)

Table of Contents

- What is the Price-to-Earnings (P/E) Ratio and how is it calculated?

- What is the difference between Trailing P/E and Forward P/E?

- How do you interpret High vs. Low P/E Ratios?

- Why does the P/E Ratio vary across different sectors?

- What are the limitations of relying solely on the P/E Ratio?

- How can P/E be used in a comprehensive investment strategy?

- Conclusion

Understanding how to value a company is the cornerstone of successful investing. Whether you are building a portfolio of global securities or analysing potential growth stocks, the Price-to-Earnings Ratio (P/E) remains one of the most widely used metrics in financial markets. It offers a quick snapshot of how the market values a company relative to its actual earnings, helping investors determine if a stock is overvalued, undervalued, or fairly priced.

What is the Price-to-Earnings (P/E) Ratio and how is it calculated?

Understanding how to value a company is the cornerstone of successful investing. Whether you are building a portfolio of global securities or analysing potential growth stocks, the Price-to-Earnings Ratio (P/E) remains one of the most widely used metrics in financial markets. It offers a quick snapshot of how the market values a company relative to its actual earnings, helping investors determine if a stock is overvalued, undervalued, or fairly priced.

The formula is straightforward:

P/E Ratio = Market Value per Share / Earnings per Share (EPS)

For example, if a company trading on the US stock market has a share price of $100 and an EPS of $5, its P/E ratio would be 20 ($100 / $5). This means investors are currently paying 20 times the company’s annual earnings to own the stock.

For investors using global equities brokerage services to access markets like the NYSE or LSE, understanding this calculation is the first step in filtering potential investment opportunities. It standardises the cost of earnings across different companies, allowing for easier comparison.

What is the difference between Trailing P/E and Forward P/E?

While the basic calculation remains the same, the data used for “earnings” can change the ratio significantly. There are two primary variations:

Trailing P/E: This uses the earnings per share over the last 12 months (TTM). It is grounded in factual, historical data reported in company financial statements. However, because it looks backward, it may not reflect the company’s future potential or recent changes in the economic environment.

Forward P/E: This uses projected earnings for the next 12 months, based on analyst estimates. Forward P/E is often more useful for investors focused on future growth, as markets are generally forward-looking mechanisms. However, it carries the risk of inaccuracy if the company fails to meet analyst expectations.

Sophisticated investors often compare both. A Forward P/E that is significantly lower than the Trailing P/E suggests that analysts expect earnings to grow, potentially making the stock an attractive buy. Conversely, if the Forward P/E is higher, earnings may be expected to shrink.

Access the World’s Top Equity Markets

Trade US, European, and Asian stocks with the security of a trusted, DIFC-regulated broker.

How do you interpret High vs. Low P/E Ratios?

Interpreting the P/E ratio is not as simple as “low is good, high is bad.” The context matters immensely, particularly regarding your investment style—whether you prefer buy and hold strategies or active trading.

High P/E Ratio (Growth Stocks): A high P/E often indicates that the market expects high future growth. Investors are willing to pay a premium today because they anticipate earnings will surge in the future. Technology companies and innovative startups often trade at high P/E multiples. However, a very high P/E can also signal that a stock is overvalued and due for a correction.

Low P/E Ratio (Value Stocks): A low P/E can indicate that a stock is undervalued, potentially offering a bargain opportunity. These are often mature companies with stable cash flows. However, caution is required; a low P/E can sometimes be a “value trap,” where the price is low because the company’s fundamentals are deteriorating.

For investors exploring Exchange Traded Funds (ETFs), looking at the weighted average P/E of an entire fund can also help assess whether a specific market index is overheated or reasonably priced.

Why does the P/E Ratio vary across different sectors?

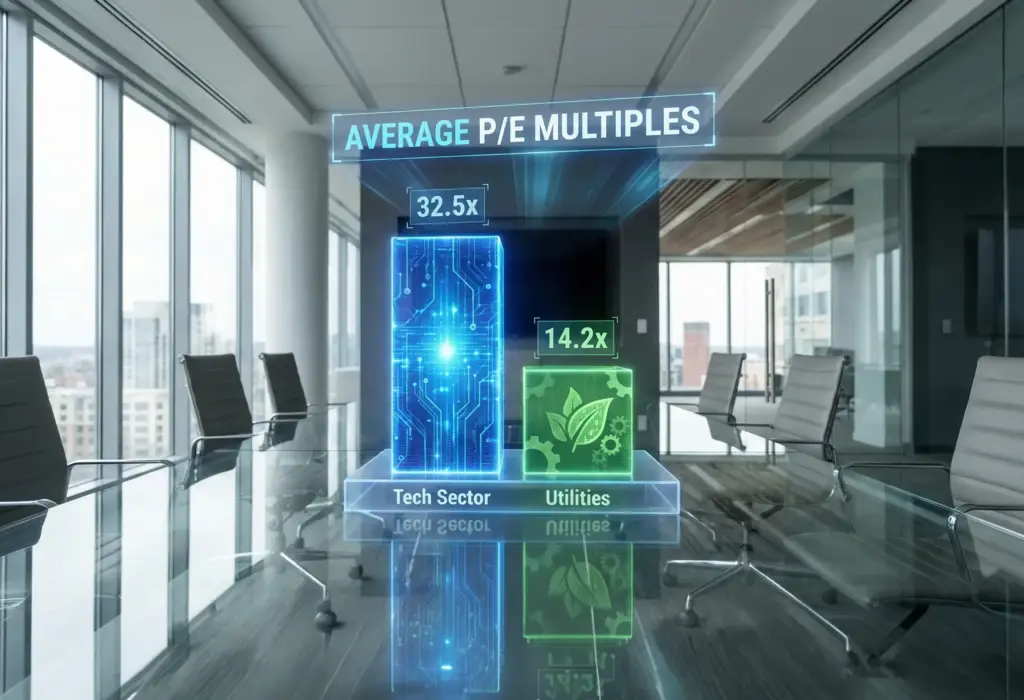

Comparing the P/E ratio of a tech company to that of a utility provider is like comparing apples to oranges. Different industries have different average P/E ratios due to their growth prospects and risk profiles.

- Technology & Biotech: Typically have higher P/E ratios (e.g., 25x or higher) because investors price in rapid expansion and innovation.

- Utilities & Financials: Often have lower P/E ratios (e.g., 10x to 15x) because they are mature industries with regulated, steady, but slower growth.

This is why a sector rotation strategy is critical. When the economy is booming, capital often flows into high P/E sectors. In recessionary periods, money tends to rotate into low P/E, defensive sectors. Always compare a company’s P/E to its industry peers rather than the broader market to get an accurate valuation.

What are the limitations of relying solely on the P/E Ratio?

While powerful, the P/E ratio should never be used in isolation. It has distinct limitations that savvy investors must acknowledge:

- Debt is Ignored: The P/E ratio looks at equity value but ignores a company’s debt load. Two companies might have the same P/E, but if one is heavily leveraged, it carries significantly higher risk.

- Earnings Manipulation: Companies can sometimes adjust their accounting practices to boost reported earnings temporarily, artificially lowering their P/E to look more attractive.

- Cyclical Industries: For companies in cyclical sectors (like commodities or heavy industry), P/E ratios can be misleading. At the peak of a cycle, earnings are high, making the P/E look artificially low just before the cycle turns.

For investors seeking to mitigate these specific equity risks, diversifying into structured products can offer tailored exposure with defined risk parameters, serving as a hedge against the volatility inherent in pure equity valuation models.

Expert Investment Advisory

Get professional support to navigate complex valuations and build a resilient portfolio.

How can P/E be used in a comprehensive investment strategy?

While powerful, the P/E ratio should never be used in isolation. It has distinct limitations that savvy investors must acknowledge:

- Debt is Ignored: The P/E ratio looks at equity value but ignores a company’s debt load. Two companies might have the same P/E, but if one is heavily leveraged, it carries significantly higher risk.

- Earnings Manipulation: Companies can sometimes adjust their accounting practices to boost reported earnings temporarily, artificially lowering their P/E to look more attractive.

- Cyclical Industries: For companies in cyclical sectors (like commodities or heavy industry), P/E ratios can be misleading. At the peak of a cycle, earnings are high, making the P/E look artificially low just before the cycle turns.

For investors seeking to mitigate these specific equity risks, diversifying into structured products can offer tailored exposure with defined risk parameters, serving as a hedge against the volatility inherent in pure equity valuation models.

Conclusion

While powerful, the P/E ratio should never be used in isolation. It has distinct limitations that savvy investors must acknowledge:

- Debt is Ignored: The P/E ratio looks at equity value but ignores a company’s debt load. Two companies might have the same P/E, but if one is heavily leveraged, it carries significantly higher risk.

- Earnings Manipulation: Companies can sometimes adjust their accounting practices to boost reported earnings temporarily, artificially lowering their P/E to look more attractive.

- Cyclical Industries: For companies in cyclical sectors (like commodities or heavy industry), P/E ratios can be misleading. At the peak of a cycle, earnings are high, making the P/E look artificially low just before the cycle turns.

For investors seeking to mitigate these specific equity risks, diversifying into structured products can offer tailored exposure with defined risk parameters, serving as a hedge against the volatility inherent in pure equity valuation models.

Frequently Asked Questions (FAQs)

There is no single “magic number,” but historically, the average P/E for the S&P 500 has hovered around 15x to 20x. A P/E below 15 is often considered “value” territory, while anything above 25 may be considered “growth” or expensive. However, a “good” ratio depends entirely on the industry. For example, a P/E of 30 might be normal for a tech company but alarmingly high for a bank.

Yes, but it is rarely displayed as a negative number. If a company has negative earnings (a loss), the P/E calculation would technically result in a negative figure. In most financial data feeds and brokerage apps, this is simply shown as “N/A” (Not Applicable) or left blank, indicating the company is currently unprofitable.

Not necessarily. A very low P/E can sometimes signal a “value trap.” This happens when a stock appears cheap because the price has dropped significantly, but the drop is due to fundamental problems—like declining market share or looming regulatory issues—that will cause future earnings to crash. Always check why the price is low before investing.

High P/E ratios in these cases reflect investor confidence in massive future growth. Investors are willing to pay a premium today (a high multiple) because they believe the company’s earnings will multiply exponentially in the coming years. Essentially, you are paying for the future potential rather than the current reality.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Bond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read MoreHow Structured Products Work

How Structured Products Work A Complete Guide for Investors Table...

Read MoreStock Valuation Methods

Stock Valuation Methods A Comprehensive Guide to Estimating Fair Value...

Read MoreMinor and Exotic Currency Pairs

Minor and Exotic Currency Pairs A Trader’s Guide to Global...

Read MoreLong vs Short Positions in Derivatives

Long vs Short Positions in Derivatives A Complete Guide for...

Read MoreInvestment Grade vs Non-Investment Grade Bonds

Investment Grade vs Non-Investment Grade Bonds A Guide for UAE...

Read MoreStock Market Hours and Session Trading

Stock Market Hours and Session Trading A Global Guide for...

Read MoreOver-the-Counter (OTC) vs Exchange-Traded Derivatives

Over-the-Counter (OTC) vs Exchange-Traded Derivatives A Complete Guide for UAE...

Read MoreBonds: Face Value, Par Value & Coupon Rate

Bonds: Face Value, Par Value & Coupon Rate When venturing...

Read MoreGrowth Investing

Growth Investing The High-Risk, High-Reward Strategy for UAE Investors Growth...

Read MoreComponents of Structured Products

Components of Structured Products A Detailed Guide for UAE Investors...

Read MoreInitial Public Offering Process guide

IPO (Initial Public Offering) Process From Private to Public In...

Read MoreForex Market Structure and Hours

Forex Market Structure and Hours The Complete Guide for UAE...

Read MoreTypes of Derivatives: Futures, Options, Swaps, and Forwards

Types of Derivatives Futures, Options, Swaps, and Forwards In the...

Read MoreBond Issuers Government vs Corporate Bonds

Bond Issuers Government vs Corporate Bonds What UAE Investors Need...

Read MoreWhat Are Equities and Shares

Demystifying the Market What Are Equities and Shares? The world...

Read MoreWhat is Spot FX Trading and How Does It Work?

Decoding the Market What is Spot FX Trading and How...

Read MoreWhat are Derivatives and Their Purpose

What are Derivatives and Their Purpose The financial world is...

Read MoreIntroduction to Stock Markets

Master the Basics: An Introduction to Stock Markets and Deliverable...

Read MoreIntroduction to the Forex Market

Introduction to the Forex Market : Your Gateway to Global...

Read More