Futures Fundamentals A Strategic Guide to Capital Markets Table of...

Read MoreBond Pricing Fundamentals

A Guide for Investors

Understanding the mechanics of fixed-income securities is essential for constructing a resilient portfolio. While equities often dominate financial headlines, the bond market represents a significantly larger portion of global capital markets. For investors navigating the complexities of global market access, grasping bond pricing fundamentals is not merely academic—it is a critical skill for risk management and capital preservation.

Below, we explore the core components of bond valuation, dissecting how market forces, interest rates, and mathematical formulas converge to determine the fair value of a fixed-income asset.

What Determines the Price of a Bond?

At its core, a bond’s price is the present value of its future cash flows. When you purchase a bond, you are essentially buying a stream of future payments, which includes periodic interest payments (coupons) and the return of the principal amount (face value) at maturity.

Several intrinsic and extrinsic factors dictate this price:

- Face Value (Par Value): The amount paid to the bondholder at maturity.

- Coupon Rate: The annual interest rate paid on the bond’s face value.

- Maturity Date: The date on which the principal is repaid.

- Credit Quality: The issuer’s ability to repay, often rated by agencies like Moody’s or S&P.

- Market Interest Rates: The prevailing rates for new bonds of similar risk and maturity.

The interplay between these factors determines whether a bond trades at par (face value), at a premium (above face value), or at a discount (below face value). Investors utilizing our electronic trading platforms will often see live pricing fluctuate based on real-time shifts in these variables.

Why Do Bond Prices Move Inversely to Interest Rates?

The inverse relationship between bond prices and interest rates is perhaps the most fundamental rule of fixed-income investing. Simply put: when market interest rates rise, existing bond prices fall, and conversely, when rates fall, bond prices rise.

This occurs due to the opportunity cost of capital. If an investor holds a bond paying a 3% coupon and the central bank raises rates, causing new bonds to be issued with a 5% coupon, the older 3% bond becomes less attractive. To compete with the new, higher-yielding issues, the price of the older bond must drop until its effective yield matches the new market rate.

Conversely, if market rates decline to 2%, the older 3% bond becomes highly desirable. Investors will pay a premium for that higher income stream, driving the price up. Navigating this interest rate risk is a primary reason why sophisticated investors rely on professional brokerage services to time their entry and exit points in the fixed-income market.

How Do Yield to Maturity and Coupon Rates Interact?

To accurately value a bond, one must distinguish between the coupon rate (the fixed payment) and the Yield to Maturity (YTM). The YTM is the total anticipated return on a bond if the bond is held until it matures. It is essentially the internal rate of return (IRR) of the bond.

The relationship between the coupon rate, YTM, and price is consistent:

- Par Value: If the Coupon Rate equals the YTM, the bond trades at Par ($100).

- Discount: If the Coupon Rate is lower than the YTM, the bond trades at a Discount (<$100).

- Premium: If the Coupon Rate is higher than the YTM, the bond trades at a Premium (>$100).

For example, purchasing a bond at a discount implies that the investor will receive a capital gain at maturity (the difference between the purchase price and the face value) in addition to the coupon payments. This total return profile is what smart capital allocation strategies aim to optimize.

Ready to Diversify Your Portfolio?

Access global fixed-income markets with a trusted partner.

How Is a Bond’s Fair Value Calculated?

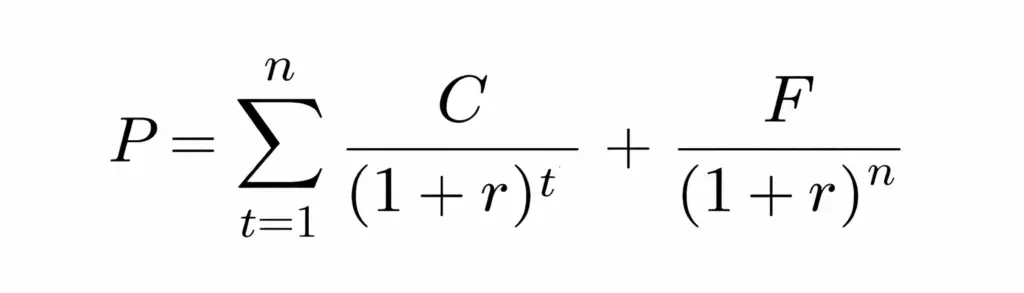

The mathematical valuation of a bond is derived by discounting its expected future cash flows back to the present day. This “Discounted Cash Flow” (DCF) method ensures that the time value of money is accounted for—acknowledging that a dollar received today is worth more than a dollar received five years from now.

The formula for calculating the price of a standard coupon bond is

- P = Current price of the bond

- C = Coupon payment per period

- r = Yield to maturity (market interest rate) per period

- n = Total number of payment periods

- F = Face value (par value) of the bond

This calculation highlights why longer-maturity bonds are more sensitive to rate changes. The further out the cash flows (n becomes larger), the more they are impacted by changes in the discount rate (r). Investors looking to execute such precise valuations often utilize the advanced analytical tools available through our proprietary trading solutions.

What Role Does Duration Play in Bond Pricing?

While YTM provides a snapshot of return, Duration measures the sensitivity of a bond’s price to changes in interest rates. It is a vital risk metric for portfolio managers.

- Macaulay Duration: The weighted average time until a bond’s cash flows are received.

- Modified Duration: An adjustment of Macaulay duration that estimates the percentage change in price for a 1% change in yield.

Higher duration implies higher volatility. For instance, a bond with a duration of 10 years will theoretically lose approximately 10% of its value if interest rates rise by 1%. Understanding duration allows investors to hedge their portfolios effectively, especially in volatile economic climates where central bank policies are shifting.

Guidance for Complex Markets

Consult with our desk for institutional-grade bond market insights.

Conclusion

Bond pricing is a sophisticated blend of mathematics and market psychology. By mastering the relationships between par value, coupon rates, yield to maturity, and duration, investors can look beyond the surface level of “fixed income” and uncover deep value opportunities. Whether assessing a sovereign treasury note or a corporate bond, the fundamental principle remains: price is a reflection of risk, time, and opportunity cost.

For investors seeking to apply these principles in the real world, PhillipCapital DIFC offers the infrastructure and expertise required to navigate global bond markets with confidence.

Frequently Asked Questions (FAQs)

For investors holding a bond until its maturity date, daily price volatility is generally less critical, as you will receive the full face value upon maturity (assuming the issuer does not default). However, price fluctuations matter significantly if you plan to sell the bond on the secondary market before it matures, as you may have to sell at a loss if interest rates have risen.

The Clean Price is the price of the bond excluding any interest that has accumulated since the last coupon payment. The Dirty Price (or full price) includes this accrued interest and represents the actual amount an investor pays to purchase the bond. In professional markets, quotes are usually given in Clean Price, while the settlement amount is the Dirty Price.

Inflation is the enemy of fixed income. Because bonds pay a fixed stream of cash, high inflation erodes the purchasing power of those future payments. When inflation expectations rise, investors demand higher yields to compensate for this loss of purchasing power, which drives current bond prices down.

Long-term bonds have a higher duration, meaning their cash flows are further in the future. This makes them more sensitive to changes in interest rates. A 1% change in interest rates will cause a much larger price swing in a 30-year bond compared to a 2-year note, simply because the discount rate is applied over a longer period.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Bond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read MoreHow Structured Products Work

How Structured Products Work A Complete Guide for Investors Table...

Read MoreStock Valuation Methods

Stock Valuation Methods A Comprehensive Guide to Estimating Fair Value...

Read MoreMinor and Exotic Currency Pairs

Minor and Exotic Currency Pairs A Trader’s Guide to Global...

Read MoreLong vs Short Positions in Derivatives

Long vs Short Positions in Derivatives A Complete Guide for...

Read MoreInvestment Grade vs Non-Investment Grade Bonds

Investment Grade vs Non-Investment Grade Bonds A Guide for UAE...

Read MoreStock Market Hours and Session Trading

Stock Market Hours and Session Trading A Global Guide for...

Read MoreOver-the-Counter (OTC) vs Exchange-Traded Derivatives

Over-the-Counter (OTC) vs Exchange-Traded Derivatives A Complete Guide for UAE...

Read MoreBonds: Face Value, Par Value & Coupon Rate

Bonds: Face Value, Par Value & Coupon Rate When venturing...

Read MoreGrowth Investing

Growth Investing The High-Risk, High-Reward Strategy for UAE Investors Growth...

Read MoreComponents of Structured Products

Components of Structured Products A Detailed Guide for UAE Investors...

Read MoreInitial Public Offering Process guide

IPO (Initial Public Offering) Process From Private to Public In...

Read MoreForex Market Structure and Hours

Forex Market Structure and Hours The Complete Guide for UAE...

Read MoreTypes of Derivatives: Futures, Options, Swaps, and Forwards

Types of Derivatives Futures, Options, Swaps, and Forwards In the...

Read MoreBond Issuers Government vs Corporate Bonds

Bond Issuers Government vs Corporate Bonds What UAE Investors Need...

Read MoreWhat Are Equities and Shares

Demystifying the Market What Are Equities and Shares? The world...

Read MoreWhat is Spot FX Trading and How Does It Work?

Decoding the Market What is Spot FX Trading and How...

Read MoreWhat are Derivatives and Their Purpose

What are Derivatives and Their Purpose The financial world is...

Read MoreIntroduction to Stock Markets

Master the Basics: An Introduction to Stock Markets and Deliverable...

Read MoreIntroduction to the Forex Market

Introduction to the Forex Market : Your Gateway to Global...

Read More