Bond Valuation Methods Mastering Bond Valuation Methods and Formulas: A...

Read MoreBond Issuers Government vs Corporate Bonds

What UAE Investors Need to Know

In the current economic landscape of late 2025, where interest rates are stabilizing and global markets offer new opportunities, fixed-income securities remain a cornerstone of a resilient portfolio. For investors in the UAE, the choice often boils down to two primary categories: Government Bonds and Corporate Bonds.

While both serve the purpose of raising capital, their risk profiles, yield potentials, and roles in your portfolio differ significantly. At PhillipCapital DIFC, we believe that informed decisions are the most profitable ones. This guide breaks down the critical differences between these bond issuers and helps you decide which aligns best with your financial goals.

What is the fundamental difference between Government and Corporate Bonds?

The core difference lies in the issuer—the entity borrowing your money.

- Government Bonds (Sovereign Debt): These are issued by national governments. When you buy a US Treasury Bond or a UK Gilt, you are essentially lending money to that country’s government. These funds are typically used to finance public projects, infrastructure, or manage national debt. Because they are backed by the taxing power of a nation, major sovereign bonds are considered “risk-free” benchmarks.

- Corporate Bonds: These are issued by companies—ranging from global giants like Apple or Tesla to emerging market firms—to fund business expansions or M&A activities. Unlike stocks, where you own a piece of the company, bonds are simply a loan you provide to them.

Expert Insight: For UAE investors, diversifying between high-grade US Treasuries (for safety) and Corporate Bonds (for yield) is a common strategy.

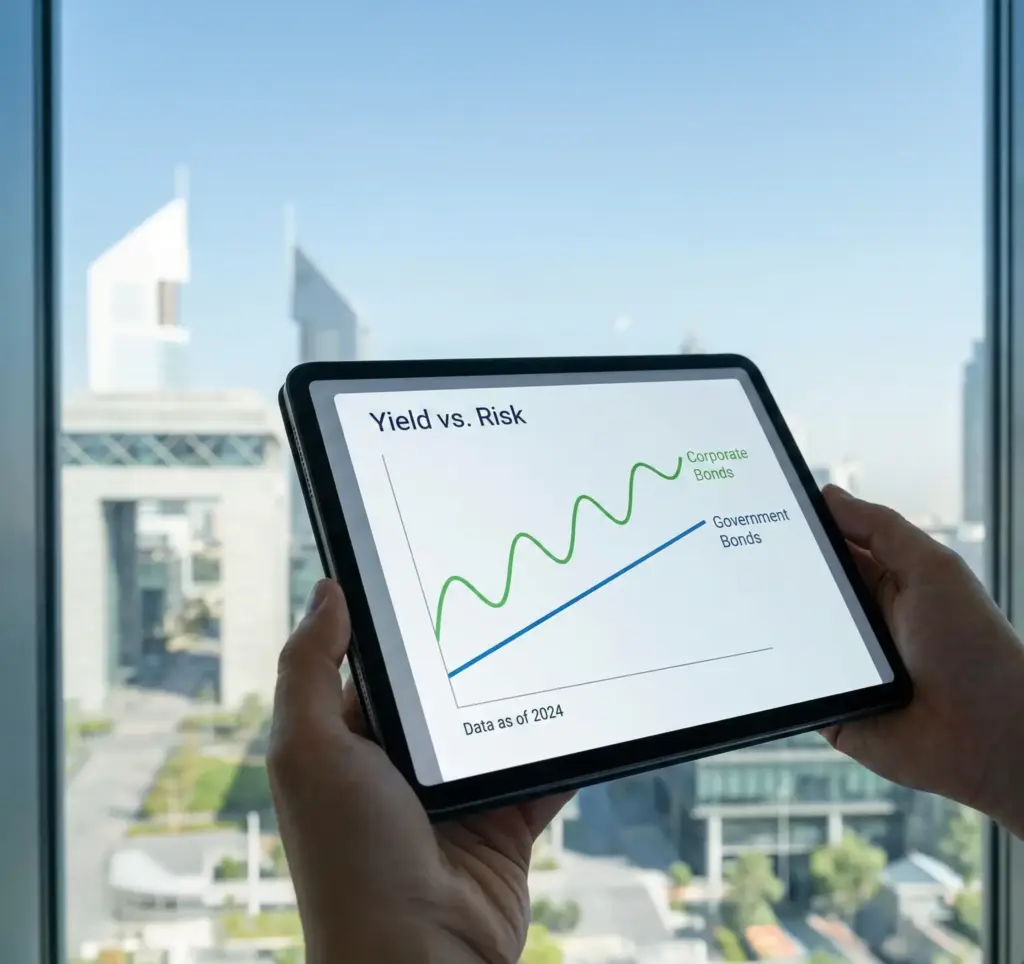

How do the risk and return profiles compare?

The “Risk-Reward Trade-off” is the golden rule of bond investing.

- Government Bonds: Generally offer lower yields because the risk of default is minimal. In times of economic uncertainty (like the volatility seen in early 2024), investors flock to government bonds as a “safe haven.”

- Corporate Bonds: To attract investors, companies must offer higher coupon rates (interest payments).

- Investment Grade: Issued by stable companies with good credit ratings (e.g., BBB and above).

- High-Yield (Junk) Bonds: Issued by companies with lower credit ratings. These offer significantly higher returns to compensate for the higher risk of default.

Looking to trade with leverage?

Explore our CFD options on Bond Indices to hedge your physical portfolio.

What are the tax implications for UAE residents investing in global bonds?

One of the most significant advantages for investors based in the UAE is the tax efficiency.

- Personal Income Tax: As of late 2025, UAE residents generally do not pay personal income tax on interest income or capital gains earned from investing in foreign bonds. This means the coupon payments you receive from a US Corporate Bond or a UK Gilt are typically yours to keep, tax-free, locally.

- Withholding Tax: It is important to note that the source country might withhold tax. However, the UAE has an extensive network of Double Taxation Avoidance Agreements (DTAA).

- Corporate Investors: For UAE corporations, the 9% Corporate Tax applies to net income exceeding AED 375,000. Bond interest is considered taxable income unless specific free zone exemptions apply.

What are the tax implications for UAE residents investing in global bonds?

Liquidity refers to how quickly you can convert your bond into cash without affecting its price.

- Government Bonds: The market for major sovereign debt (like US Treasuries) is the most liquid market in the world. You can buy or sell millions of dollars worth of these bonds in seconds with very tight spreads.

- Corporate Bonds: Liquidity varies. Bonds issued by massive blue-chip companies are highly liquid. However, bonds from smaller companies may trade less frequently.

Why should I choose PhillipCapital DIFC for bond trading?

- Regulatory Trust: We are regulated by the DFSA (Dubai Financial Services Authority), ensuring your investments are handled with the highest standards of transparency and security.

- Global Access: We don’t just offer local regional bonds. Our platform connects you to global exchanges, allowing you to buy US Treasuries, European Sovereign debt, and Asian Corporate bonds all from one account in the DIFC.

- Institutional Pricing: Leveraging our global network (PhillipCapital Group has roots in Singapore since 1975), we provide retail investors with competitive pricing often reserved for institutional desks.

Ready to build a balanced portfolio?

Open your account today and access over 1,000+ global bond instruments.

Which bond type is right for me in the current 2025/2026 market outlook?

The “right” choice depends on your financial goals:

- Choose Government Bonds if: Your priority is capital preservation. If you are nearing retirement or need to park cash for a short period (1-3 years) with zero tolerance for loss, short-term US Treasuries or highly-rated sovereign debt are ideal.

- Choose Corporate Bonds if: You are in a growth phase and want to beat inflation. If you can tolerate some market fluctuation, Investment Grade corporate bonds currently offer attractive yields that outperform standard bank deposits.

Stay updated with weekly insights for smarter bond timing

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Contrarian Investing /Dip Buying

Contrarian Investing / Dip buying Mastering the Art of Contrarian...

Read MorePartial Capital Protection

Partial Capital Protection Partial Capital Protection: The Strategic Bridge Between...

Read MoreFutures Pricing And Valuation

Futures Pricing And Valuation Table of Contents What is the...

Read MoreThe Inverse Relationship Between Bond Prices and Yields

The Inverse Relationship Between Bond Prices and Yields Table of...

Read MoreGrowth at Reasonable Price (GARP)

Growth at Reasonable Price (GARP) Mastering Growth at Reasonable Price...

Read MoreCapital Protection Structures

Capital Protection Structures Strategic Wealth Preservation: A Comprehensive Guide to...

Read Moreunderstanding dividend yield investment guide

Dividend Yield The Strategic Guide to Dividend Yield: Maximizing Passive...

Read MoreCurrent Yield vs Yield to Maturity

Understanding Current Yield vs. Yield to Maturity Understanding Current Yield...

Read MoreHow Futures Exchanges Work

How Futures Exchanges Work Understanding the Mechanics of Global Futures...

Read MoreBond Yield Vs Interest Rates

Bond Yield Vs Interest Rates Understanding the Relationship Between Bond...

Read MoreUnderstanding Exchange Rates

Understanding Exchange Rates In an increasingly interconnected global economy, the...

Read MoreBond Yield to Maturity (YTM)

Bond Yield to Maturity (YTM) Understanding Bond Yield to Maturity...

Read MoreUnderstanding Futures Contracts

Understanding Futures Contracts Understanding Futures Contracts in Global Markets In...

Read MoreCalculating Bond Price And Yield

Calculating Bond Price And Yield Understanding Bond Valuation: A Comprehensive...

Read MoreEnterprise Value And Ev/Ebitda

Enterprise Value And EV/EBITDA Enterprise Value and EV/EBITDA: A Comprehensive...

Read MorePrice-to-Sales Ratio (P/S)

Price-to-Sales Ratio (P/S) Understanding the Price-to-Sales Ratio (P/S) in Modern...

Read MorePrice-to-Book Ratio

Price-to-Book Ratio (P/B) The Essential Guide for Identifying Undervalued Stocks...

Read MoreBond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read More