Bond Valuation Methods Mastering Bond Valuation Methods and Formulas: A...

Read MoreEnterprise Value And EV/EBITDA

Enterprise Value and EV/EBITDA: A Comprehensive Guide for Strategic Investors

The world of equity analysis often moves beyond simple share prices. For sophisticated investors navigating the global capital markets, understanding the holistic value of a firm is paramount. This guide explores the intricacies of Enterprise Value (EV) and the EV/EBITDA multiple—two pillars of modern corporate valuation.

Table of Contents

- What is Enterprise Value (EV) and how does it differ from Market Capitalization?

- How is Enterprise Value calculated?

- What is EBITDA and why is it paired with Enterprise Value?

- What is the significance of the EV/EBITDA multiple in valuation?

- How do investors interpret high vs. low EV/EBITDA ratios?

- What are the limitations of using EV/EBITDA?

- Conclusion: Integrating Valuation Metrics into Your Strategy

What is Enterprise Value (EV) and how does it differ from Market Capitalization?

While many retail investors focus solely on Market Capitalization—calculated by multiplying the share price by the total number of outstanding shares—this metric only tells part of the story. Market Cap represents the equity value of a business, essentially the “sticker price” for shareholders.

However, Enterprise Value (EV) is a more comprehensive measure. It is often described as the theoretical “takeover price” of a company. When one corporation acquires another, it doesn’t just buy the equity; it also assumes the target company’s debt. Conversely, it receives the target’s cash reserves. Therefore, EV provides a capital-structure neutral view of a company’s worth, accounting for both its equity and its obligations. For those engaging in equities trading, looking at EV ensures you aren’t ignoring the hidden leverage that could impact a firm’s long-term stability.

How is Enterprise Value calculated?

The calculation of Enterprise Value is a multi-layered process that requires a deep dive into a company’s balance sheet. The standard formula is:

EV = Market Capitalization + Total Debt + Minority Interest + Preferred Equity – Cash and Cash Equivalents.

- Total Debt: Includes both short-term and long-term loans.

- Minority Interest: The portion of a subsidiary not owned by the parent company, which must be included because the consolidated EBITDA includes 100% of the subsidiary’s earnings.

- Cash and Cash Equivalents: Subtracted because they effectively reduce the cost of acquisition.

By stripping away the “excess” cash and adding the “burden” of debt, investors gain a clearer picture of the operational value of the business assets. This level of investment research is vital for identifying undervalued gems in a crowded market.

What is EBITDA and why is it paired with Enterprise Value?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It serves as a proxy for a company’s core operational profitability. By excluding interest and taxes, it removes the effects of financing and government jurisdictions. By excluding depreciation and amortization, it ignores non-cash accounting entries that can vary based on a company’s age or accounting methods.

Pairing EV with EBITDA creates a powerful ratio because it compares the total value of the business (EV) to the cash flow available to all capital providers (EBITDA). Unlike the P/E ratio, which only looks at earnings available to shareholders, EV/EBITDA accounts for the returns available to both debt and equity holders. This makes it a preferred metric for wealth management professionals when comparing companies with vastly different debt levels.

Access Institutional-Grade Market Insights

Start trading with PhillipCapital DIFC today.

What is the significance of the EV/EBITDA multiple in valuation?

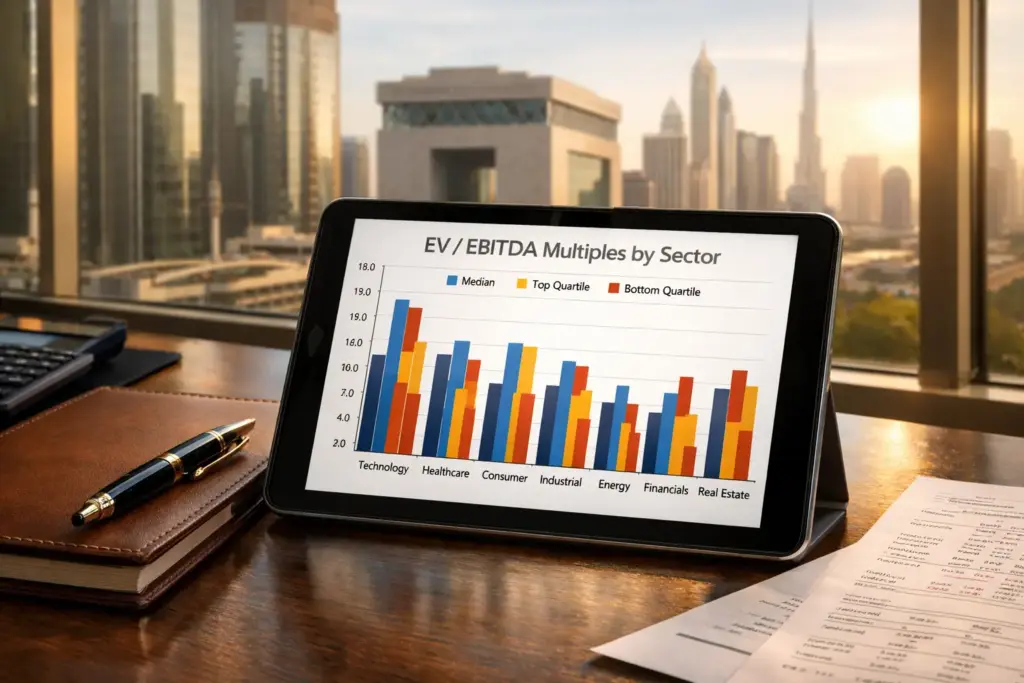

The EV/EBITDA multiple, often called the “enterprise multiple,” allows investors to compare companies within the same industry regardless of their capital structure. In the context of global asset management, this is essential. For example, a capital-intensive utility company with high debt and a software-as-a-service (SaaS) company with zero debt cannot be accurately compared using P/E ratios alone.

The enterprise multiple tells you how many years of “current” cash flow it would take to pay back the cost of acquiring the entire business. A lower multiple might suggest a company is undervalued, while a higher multiple might indicate a premium valuation due to expected high growth or market dominance.

How do investors interpret high vs. low EV/EBITDA ratios?

Interpreting these ratios requires context. A “low” ratio is generally seen as attractive, suggesting that the company is generating significant cash flow relative to its total value. This is often the hunting ground for value investors looking for dividend-yielding stocks or turnaround stories.

Conversely, a “high” ratio is common in high-growth sectors like technology or biotech. Investors are willing to pay a premium because they expect the EBITDA to grow rapidly in the future. However, a high ratio can also signal a “valuation bubble” if the projected growth fails to materialize. It is always best to compare a company’s multiple against its historical average and its peer group to determine if the pricing is justified.

What are the limitations of using EV/EBITDA?

While powerful, the EV/EBITDA multiple is not a silver bullet. One major limitation is that it ignores capital expenditures (CapEx). For companies in heavy industries—such as manufacturing or oil and gas—ignoring the cost of replacing aging equipment (depreciation) can lead to an overly optimistic view of cash flow.

Furthermore, EBITDA does not account for working capital requirements or changes in taxes. Therefore, it should always be used in conjunction with other metrics, such as Price-to-Earnings (P/E) or Price-to-Book (P/B), and supported by professional financial advisory services to ensure a holistic risk assessment.

Conclusion: Integrating Valuation Metrics into Your Strategy

Enterprise Value and the EV/EBITDA multiple provide a sophisticated lens through which to view corporate health and market pricing. By moving beyond the surface-level Market Cap and P/E ratios, investors can identify the true cost of an acquisition and the operational efficiency of a firm.

Whether you are a retail investor or managing a professional portfolio, mastering these metrics is a step toward more disciplined and informed decision-making. At PhillipCapital DIFC, we provide the tools and expertise to help you navigate these complexities within the international financial markets.

Partner with a Global Leader in Finance

Explore our bespoke investment solutions.

Frequently Asked Questions (FAQs)

It may seem counterintuitive to “add” debt to a company’s value, but think of it from an acquirer’s perspective. If you buy a business, you aren’t just buying its shares; you are also responsible for paying off its outstanding loans. Adding debt reflects the true total cost of taking over the entire enterprise.

Generally, a lower multiple suggests a company is undervalued or “cheap” relative to its earnings. However, a very low ratio can sometimes be a “value trap,” indicating that the market expects the company’s profits to decline or that the business faces significant structural risks. Always compare the ratio against industry peers.

The P/E ratio can be easily skewed by how much debt a company has or the specific tax laws of its country. EV/EBITDA is “capital-structure neutral,” meaning it allows you to compare two companies fairly even if one is funded by debt and the other by cash, providing a clearer view of core operational health.

Yes, though it is rare. A negative EV occurs when a company’s cash and cash equivalents exceed its entire Market Cap and debt combined. This essentially means the market is valuing the business at less than the “net cash” sitting in its bank account, which often signals either a deep-value opportunity or extreme investor skepticism about the company’s future.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Contrarian Investing /Dip Buying

Contrarian Investing / Dip buying Mastering the Art of Contrarian...

Read MorePartial Capital Protection

Partial Capital Protection Partial Capital Protection: The Strategic Bridge Between...

Read MoreFutures Pricing And Valuation

Futures Pricing And Valuation Table of Contents What is the...

Read MoreThe Inverse Relationship Between Bond Prices and Yields

The Inverse Relationship Between Bond Prices and Yields Table of...

Read MoreGrowth at Reasonable Price (GARP)

Growth at Reasonable Price (GARP) Mastering Growth at Reasonable Price...

Read MoreCapital Protection Structures

Capital Protection Structures Strategic Wealth Preservation: A Comprehensive Guide to...

Read Moreunderstanding dividend yield investment guide

Dividend Yield The Strategic Guide to Dividend Yield: Maximizing Passive...

Read MoreCurrent Yield vs Yield to Maturity

Understanding Current Yield vs. Yield to Maturity Understanding Current Yield...

Read MoreHow Futures Exchanges Work

How Futures Exchanges Work Understanding the Mechanics of Global Futures...

Read MoreBond Yield Vs Interest Rates

Bond Yield Vs Interest Rates Understanding the Relationship Between Bond...

Read MoreUnderstanding Exchange Rates

Understanding Exchange Rates In an increasingly interconnected global economy, the...

Read MoreBond Yield to Maturity (YTM)

Bond Yield to Maturity (YTM) Understanding Bond Yield to Maturity...

Read MoreUnderstanding Futures Contracts

Understanding Futures Contracts Understanding Futures Contracts in Global Markets In...

Read MoreCalculating Bond Price And Yield

Calculating Bond Price And Yield Understanding Bond Valuation: A Comprehensive...

Read MoreEnterprise Value And Ev/Ebitda

Enterprise Value And EV/EBITDA Enterprise Value and EV/EBITDA: A Comprehensive...

Read MorePrice-to-Sales Ratio (P/S)

Price-to-Sales Ratio (P/S) Understanding the Price-to-Sales Ratio (P/S) in Modern...

Read MorePrice-to-Book Ratio

Price-to-Book Ratio (P/B) The Essential Guide for Identifying Undervalued Stocks...

Read MoreBond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read More