Bond Valuation Methods Mastering Bond Valuation Methods and Formulas: A...

Read MoreIntroduction to Structured Products

In today’s dynamic financial landscape, traditional asset classes like equities and bonds are essential, but they may not always align perfectly with every investor’s specific risk appetite or return objectives. This is where Structured Products come into play.

Often regarded as the “bridge” between traditional investing and modern financial engineering, structured products offer a way to customize your market exposure. At Phillip Capital DIFC, we believe that sophisticated investment tools should be accessible and transparent. Whether you are looking to protect your capital or enhance your yield in a flat market, understanding structured products is the first step toward a more resilient portfolio.

What exactly are Structured Products?

At its core, a structured product is a pre-packaged investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance, or foreign currencies.

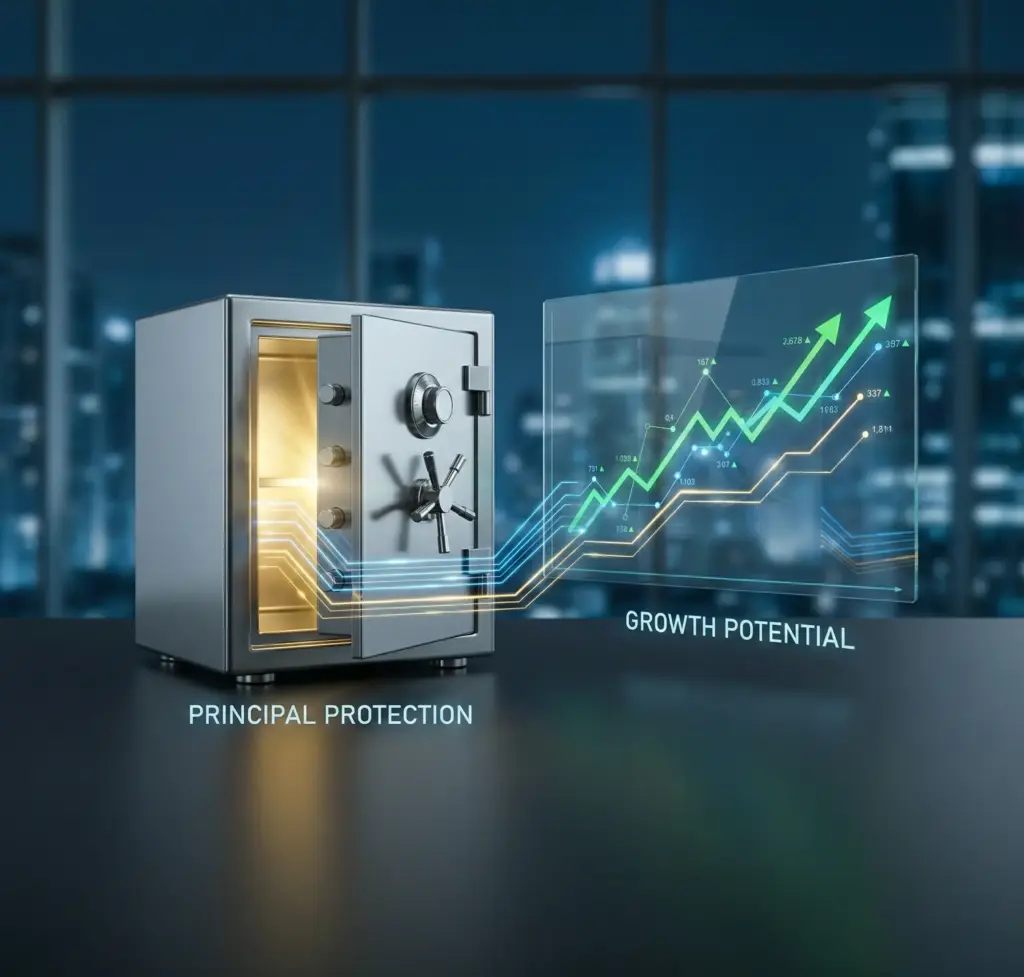

Think of it as a “hybrid” instrument. It typically combines two main components:

- A Bond Component (Capital Protection): This portion is designed to protect your initial investment (principal) and pays a return similar to a bond.

- A Derivative Component (Growth Potential): This part is linked to an underlying asset—such as the S&P 500, Gold, or a specific stock like Apple. It determines the potential upside or “bonus” return you might receive.

Unlike buying a stock directly, where your return is 1:1 with the market’s movement, a structured product changes the payoff profile. You might sacrifice some upside potential in exchange for downside protection, or vice versa. They are bespoke instruments created to meet specific needs that standard financial instruments cannot.

How do Structured Products work in practice?

Structured products work by defining a clear set of rules for your return on investment (ROI) right at the beginning. These rules usually involve a maturity date (when the product ends) and specific market scenarios.

For example, let’s look at a common type called a “Capital Protected Note”:

- The Scenario: You invest $100,000 for 3 years linked to the performance of the FTSE 100 index.

- The Terms: The product offers 100% capital protection and 80% participation in the index’s growth.

- The Outcome (Scenario A – Market Rises): If the FTSE 100 rises by 20% over 3 years, you get your $100,000 back plus a return based on that growth (e.g., $16,000 profit).

- The Outcome (Scenario B – Market Falls): If the market crashes by 30%, you still receive your original $100,000 back at maturity (subject to issuer credit risk), losing only the opportunity cost of the money.

This “defined outcome” feature is what makes them attractive for strategic planning. You know the best-case and worst-case scenarios before you invest a single dirham.

Who are Structured Products suitable for?

Structured products are not a “one-size-fits-all” solution. They are generally best suited for:

- Sophisticated Investors: Those who understand that these are fixed-term investments and are comfortable with the liquidity constraints (meaning you typically hold them until maturity).

- Investors Seeking Tailored Risk: If you are nervous about a market correction but still want to stay invested, a structured note with a “downside barrier” can offer peace of mind.

- Yield Hunters: In a low-interest-rate environment, certain structured products (like Reverse Convertibles) can offer significantly higher distinct coupons compared to traditional bonds, provided you are willing to accept some risk to your capital.

At Phillip Capital DIFC, we often categorize these clients into those seeking Growth, Income

Need help defining your investment approach?

Learn More About Our Wealth Management Solutions

What are the primary benefits of adding them to my portfolio?

The primary advantage is Customization. Standard equities force you to accept market risk as it is. Structured products allow you to reshape that risk.

- Market Access: They can provide exposure to hard-to-reach asset classes, such as foreign indices or specific commodities, without needing to buy the physical asset or open multiple international brokerage accounts.

- Defined Returns: In volatile markets, the certainty of the formula is valuable. You don’t need to guess “how much” you will make; the formula tells you exactly what you earn if the market hits X or Y level.

- Positive Returns in Flat Markets: Some structures, like “Phoenix Autocalls,” can pay a high coupon even if the market remains flat or falls slightly, something a traditional stock buy-and-hold strategy cannot do.

Important Considerations: Understanding the specific risks of Structured Products.

While structured products offer protection, they are not risk-free. Key risks include:

- Credit Risk: This is the most overlooked risk. You are essentially lending money to the financial institution (the Issuer) that created the product. If that bank goes bankrupt, you could lose your entire investment, even if the “Capital Protection” clause was in place. This is why Phillip Capital carefully selects issuers with strong credit ratings.

- Liquidity Risk: These are designed to be held to maturity. If you need to sell early, you may have to sell at a significant discount to the current value.

- Market Risk (The “Barrier”): Some products offer “conditional” protection. For example, your capital is safe unless the market falls by more than 40%. If it falls 41%, you might lose money just like a direct equity holder.

- Dividends: Generally, by investing in a structured note linked to an index, you forego the dividends that the companies in that index would pay.

Balancing risk and reward needs expert guidance.

Discover how we tailor notes to your specific needs.

How does Phillip Capital DIFC approach Structured Products for UAE investors?

As a firm regulated by the DFSA (Dubai Financial Services Authority), we adhere to strict standards of conduct. We do not view structured products as a “sales pitch” but as a strategic component of a diversified portfolio.

We leverage our global network (with roots in Singapore since 1975) to source competitive pricing from top-tier global investment banks. Because we act as a broker and advisor, we can shop around to find the structure that offers the best terms for you, rather than pushing a proprietary product from a single bank.

Whether you are looking for Sharia-compliant structures or conventional notes linked to US Tech stocks, our local presence in the DIFC ensures you have a dedicated relationship manager to guide you through the term sheets and clearly explain the “fine print” before you invest.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Contrarian Investing /Dip Buying

Contrarian Investing / Dip buying Mastering the Art of Contrarian...

Read MorePartial Capital Protection

Partial Capital Protection Partial Capital Protection: The Strategic Bridge Between...

Read MoreSpot vs Forward Rates

Spot Vs Forward Rates Understanding Spot vs. Forward Rates In...

Read MoreFutures Pricing And Valuation

Futures Pricing And Valuation Table of Contents What is the...

Read MoreThe Inverse Relationship Between Bond Prices and Yields

The Inverse Relationship Between Bond Prices and Yields Table of...

Read MoreGrowth at Reasonable Price (GARP)

Growth at Reasonable Price (GARP) Mastering Growth at Reasonable Price...

Read MoreCapital Protection Structures

Capital Protection Structures Strategic Wealth Preservation: A Comprehensive Guide to...

Read Moreunderstanding dividend yield investment guide

Dividend Yield The Strategic Guide to Dividend Yield: Maximizing Passive...

Read MoreCurrent Yield vs Yield to Maturity

Understanding Current Yield vs. Yield to Maturity Understanding Current Yield...

Read MoreHow Futures Exchanges Work

How Futures Exchanges Work Understanding the Mechanics of Global Futures...

Read MoreBond Yield Vs Interest Rates

Bond Yield Vs Interest Rates Understanding the Relationship Between Bond...

Read MoreUnderstanding Exchange Rates

Understanding Exchange Rates In an increasingly interconnected global economy, the...

Read MoreBond Yield to Maturity (YTM)

Bond Yield to Maturity (YTM) Understanding Bond Yield to Maturity...

Read MoreUnderstanding Futures Contracts

Understanding Futures Contracts Understanding Futures Contracts in Global Markets In...

Read MoreCalculating Bond Price And Yield

Calculating Bond Price And Yield Understanding Bond Valuation: A Comprehensive...

Read MoreEnterprise Value And Ev/Ebitda

Enterprise Value And EV/EBITDA Enterprise Value and EV/EBITDA: A Comprehensive...

Read MorePrice-to-Sales Ratio (P/S)

Price-to-Sales Ratio (P/S) Understanding the Price-to-Sales Ratio (P/S) in Modern...

Read MorePips and Basis Points

Understanding Pips and Basis Points in Financial Markets Table of...

Read MorePrice-to-Book Ratio

Price-to-Book Ratio (P/B) The Essential Guide for Identifying Undervalued Stocks...

Read MoreBid-Ask Spreads In Forex

Bid-Ask Spreads In Forex Table of Contents What Exactly Is...

Read MoreFutures Fundamentals

Futures Fundamentals A Strategic Guide to Capital Markets Table of...

Read MoreBond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MoreRisk and Return Profile

Understanding the Risk and Return Profile A Guide for Strategic...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreNotional Value vs Market Value

Notional Value vs Market Value Table of Contents What Is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read More