Bond Valuation Methods Mastering Bond Valuation Methods and Formulas: A...

Read More

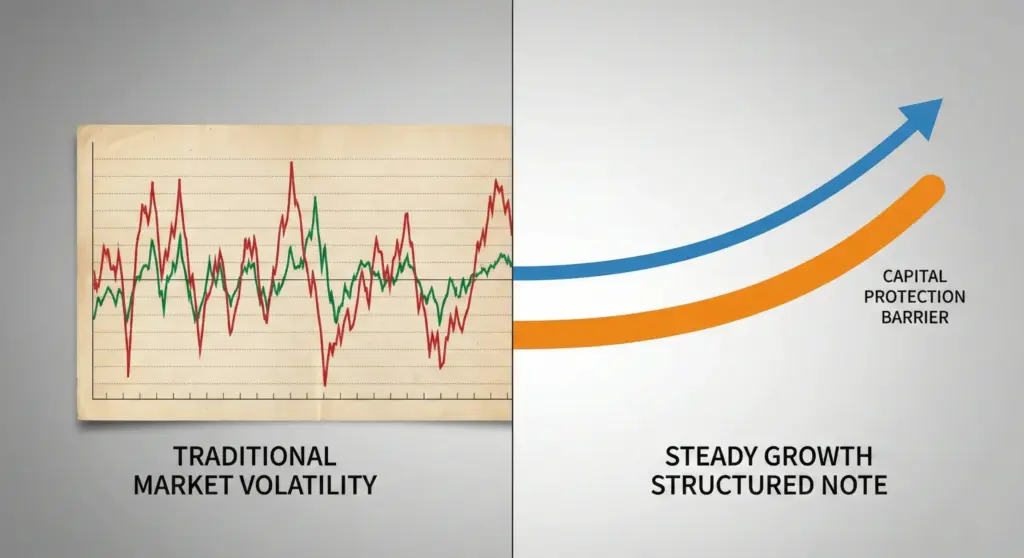

In the dynamic financial landscape of the UAE, traditional investment vehicles like bonds and equities are often not enough to meet the specific risk-return appetites of sophisticated investors. Enter Structured Notes—a powerful tool in modern wealth management that bridges the gap between fixed income and market equity.

At PhillipCapital DIFC, we believe in empowering our clients with knowledge. This guide answers your most pressing questions about Structured Notes, detailing how they can enhance yields and protect capital in uncertain markets.

A Structured Note is a hybrid financial instrument that combines the features of a traditional bond with those of a derivative (like an option). Think of it as a pre-packaged investment strategy. Unlike a standard stock that moves 1-to-1 with the market, a Structured Note allows you to customize your payout.

Essentially, it is a debt obligation issued by a financial institution, but instead of paying a fixed interest rate, the return is linked to the performance of an underlying asset—such as a specific stock, a global index (like the S&P 500), commodities (like Gold), or even foreign currencies. This structure allows investors to achieve specific goals, such as generating higher yields than a bank deposit or protecting their initial capital against market downturns.

The beauty of Structured Notes lies in their versatility. They are not “one-size-fits-all.” At PhillipCapital DIFC, we can tailor these notes to match your specific market view.

A typical note is constructed using two main building blocks:

When you invest, the issuer uses the majority of your funds to buy the bond and the remainder to purchase the option. The performance of that option determines your final payout.

This depends entirely on the “protection barrier” set when you buy the note. This is a crucial concept for UAE investors to understand.

While there are limitless variations, three specific types are highly popular among our clients:

Explore Our Range of Trading Products & Solutions

Transparency is a core value at PhillipCapital. It is vital to understand the risks:

Investing in Structured Notes requires a regulated, experienced partner. As a firm regulated by the DFSA (Dubai Financial Services Authority), PhillipCapital DIFC ensures that every product offered is appropriate for your classification as an investor.

It depends on your goal. Buying the stock directly gives you unlimited upside potential but 100% downside risk. Buying a Structured Note is for investors who are willing to cap their potential profit in exchange for a safety cushion against losses. It’s a trade-off: security and income vs. maximum growth.

Technically, yes, but it is not recommended. Structured Notes are designed to be held until they mature. If you try to sell early (on the secondary market), you may get back significantly less than your initial investment because the price will fluctuate based on interest rates, time left, and market volatility.

It is generally considered “good” but comes with a catch. If a note is “Autocalled,” it means the market performed well, so the note ends early, and you get your capital back plus the agreed profit immediately. The “catch” is Reinvestment Risk: you now have cash back in your hand sooner than expected and must find a new place to invest it, potentially when interest rates or market deals are less attractive.

Structured Notes offer a unique “middle ground” for investors—providing the potential for equity-like returns with bond-like features. Whether you want to generate income in a flat market or protect your capital in a volatile one, these instruments can be tailored to meet your precise needs.

Disclaimer: Structured products involve derivatives and may not be suitable for all investors. Please ensure you fully understand the risks involved before trading.

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Bond Valuation Methods Mastering Bond Valuation Methods and Formulas: A...

Read MoreContrarian Investing / Dip buying Mastering the Art of Contrarian...

Read MorePartial Capital Protection Partial Capital Protection: The Strategic Bridge Between...

Read MoreFutures Pricing And Valuation Table of Contents What is the...

Read MoreThe Inverse Relationship Between Bond Prices and Yields Table of...

Read MoreGrowth at Reasonable Price (GARP) Mastering Growth at Reasonable Price...

Read MoreCapital Protection Structures Strategic Wealth Preservation: A Comprehensive Guide to...

Read MoreDividend Yield The Strategic Guide to Dividend Yield: Maximizing Passive...

Read MoreUnderstanding Current Yield vs. Yield to Maturity Understanding Current Yield...

Read MoreHow Futures Exchanges Work Understanding the Mechanics of Global Futures...

Read MoreBond Yield Vs Interest Rates Understanding the Relationship Between Bond...

Read MoreUnderstanding Exchange Rates In an increasingly interconnected global economy, the...

Read MoreBond Yield to Maturity (YTM) Understanding Bond Yield to Maturity...

Read MoreUnderstanding Futures Contracts Understanding Futures Contracts in Global Markets In...

Read MoreCalculating Bond Price And Yield Understanding Bond Valuation: A Comprehensive...

Read MoreEnterprise Value And EV/EBITDA Enterprise Value and EV/EBITDA: A Comprehensive...

Read MorePrice-to-Sales Ratio (P/S) Understanding the Price-to-Sales Ratio (P/S) in Modern...

Read MorePrice-to-Book Ratio (P/B) The Essential Guide for Identifying Undervalued Stocks...

Read MoreBond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency Table of Contents What is...

Read MoreBond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read MorePhillipCapital DIFC is the best online trading broker in the UAE, offering secure and advanced solutions for global investors and traders.

You should carefully consider your objectives, financial situation, needs, and level of experience before engaging in trading activities. You should be aware of all the risks associated with trading on margin. Rolling Spot Contracts and CFDs are complex instruments and carry a high risk of losing money rapidly due to leverage.

PhillipCapital (DIFC) Private Limited (a member of the PhillipCapital Group) is incorporated in the Dubai International Financial Centre (“DIFC”) with its business address at 417, Liberty House, Financial Centre, Dubai, United Arab Emirates, and is regulated by the Dubai Financial Services Authority (“DFSA”) under reference No. F003474. Some of the products and services mentioned on this site may be offered through other PhillipCapital group offices and not directly by PhillipCapital (DIFC) Private Limited. All Rights Reserved.

PhillipCapital (DIFC) Private Limited does not offer its services to residents of the Democratic Republic of Korea, Iran, and the Russian Federation.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation.