Bond Valuation Methods Mastering Bond Valuation Methods and Formulas: A...

Read MoreHow Structured Products Work

A Complete Guide for Investors

Table of Contents

- What Is a Structured Product and How Is It Created?

- What Are the Key Components of a Structured Note?

- How Do Structured Products Protect Capital or Enhance Yields?

- What Are the Most Common Types of Structured Products?

- What Are the Main Risks Investors Should Be Aware Of?

- Who Should Invest in Structured Products?

- Conclusion

What Is a Structured Product and How Is It Created?

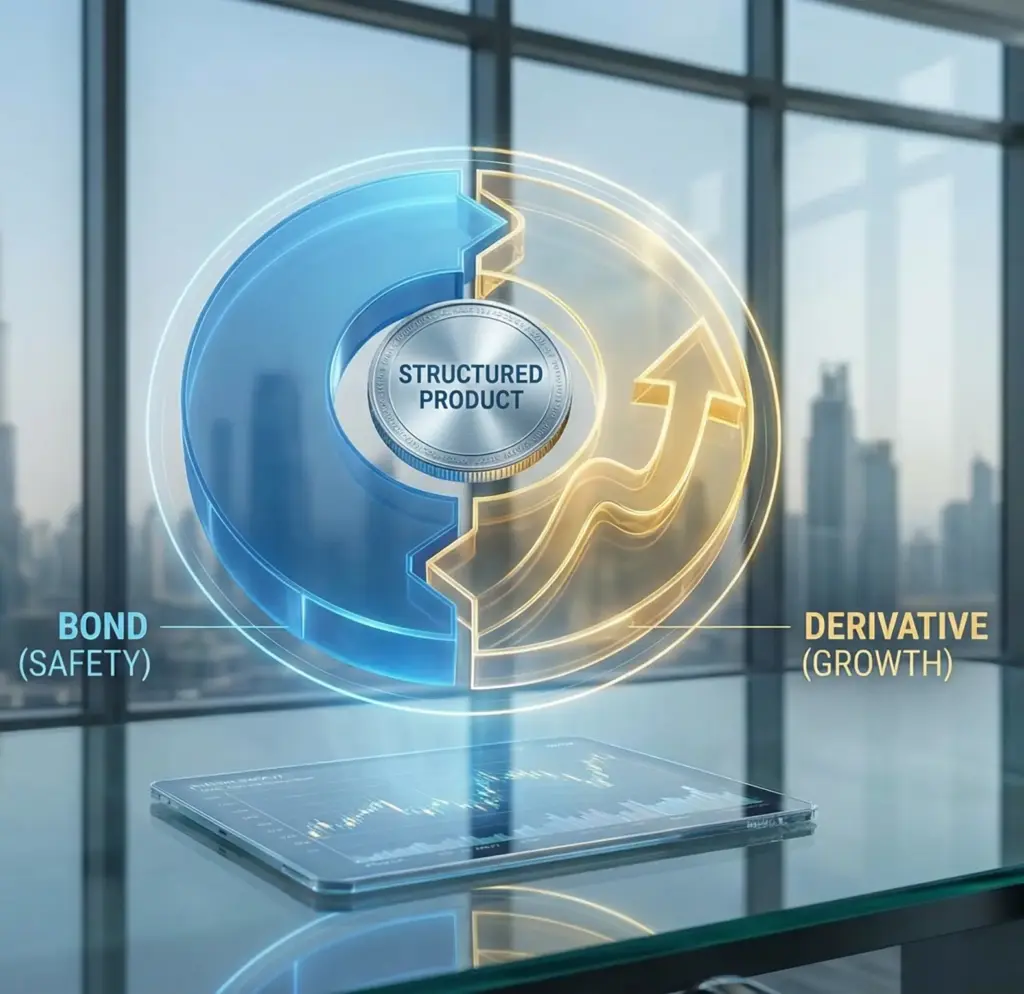

A structured product is a pre-packaged investment strategy that typically combines two distinct financial instruments into a single unit. Unlike buying a standard stock or bond, where your returns are directly tied to the asset’s price movement, a structured product essentially “engineers” a specific risk-return payoff.

These products are created by investment banks to meet specific investor needs that traditional markets cannot satisfy alone. For example, an investor might want the growth potential of the S&P 500 but with the safety of a government bond. To achieve this, the issuer combines a zero-coupon bond (for capital protection) with an option component (for market participation).

By customizing these elements, issuers can create products that offer capital protection, yield enhancement, or access to hard-to-reach asset classes. For a foundational understanding of these instruments and how we approach them at Phillip Capital, you can review our introduction to structured products.

What Are the Key Components of a Structured Note?

To understand how these products work, it helps to deconstruct them into their two primary “building blocks.”

- The Note (Debt Component): This is the “safe” part of the structure. It is essentially a bond issued by a financial institution. Its primary job is to protect your principal. In a capital-protected product, the issuer invests a large portion of your capital (e.g., 80-90%) into a zero-coupon bond that will mature at the full face value of your investment after a set period.

- The Derivative (Investment Component): The remaining capital is used to purchase a derivative, such as a call or put option. This component is linked to an “underlying asset”—which could be a single stock, a basket of equities, an index like the Nasdaq, or even a currency pair. Understanding what derivatives are and their purpose is crucial, as the performance of this specific component determines the “extra” return or coupon you receive.

By adjusting the ratio between the note and the derivative, issuers can tailor the product to be conservative (more bond, less option) or aggressive (less bond, more option).

Designed for Your Financial Objectives

Get access to global structured notes designed for your risk profile.

How Do Structured Products Protect Capital or Enhance Yields?

The “magic” of structured products lies in their ability to reshape risk. They typically fall into two main strategic goals:

- Capital Protection: In uncertain markets, investors prioritize safety. A capital-protected note guarantees the return of 100% (or a partial percentage) of your initial investment at maturity, provided the issuer remains solvent. Even if the stock market crashes, your principal is safe because it is secured by the bond component. If the market rises, you participate in the gains through the option component. This allows conservative investors to gain exposure to volatile assets like US Equities & ETFs while strictly managing their downside risk.

Yield Enhancement: In low-interest-rate environments, traditional bonds may offer unattractive returns. Yield enhancement products, such as Reverse Convertibles, offer significantly higher coupon payments (e.g., 8-12% p.a.). The trade-off is that you take on more risk; if the underlying asset falls below a certain “barrier” level, your capital may be at risk

What Are the Most Common Types of Structured Products?

While the possibilities are endless, most structured products in the UAE market fall into a few popular categories:

- Principal Protected Notes (PPNs): Ideal for conservative investors who want exposure to markets like Gold or the S&P 500 without risking their initial capital.

- Autocallables: These are very popular for generating income. The product has set observation dates. If the underlying asset is above a certain level on that date, the product “automatically calls” (matures early), paying you your capital plus a predefined bonus coupon.

- Reverse Convertibles: These pay a high fixed coupon regardless of market movement, but your principal repayment depends on the asset not falling below a specific “knock-in” barrier.

- Participation Notes: These offer 1:1 exposure to an asset (like a foreign index) but without the need for complex foreign exchange accounts or international brokerage setups. You can even structure notes around commodities; checking our available DGCX products can give you an idea of how gold and other local commodities are traded.

What Are the Main Risks Investors Should Be Aware Of?

Despite their benefits, structured products are not risk-free. It is vital to look beyond the headline return:

- Credit Risk: This is the most critical risk. When you buy a structured note, you are essentially lending money to the issuing bank (e.g., Goldman Sachs, JP Morgan, or similar). If that bank goes bankrupt, you could lose your entire investment, even if the “underlying asset” performed well.

- Liquidity Risk: These products are designed to be held until maturity (e.g., 1 to 5 years). While a secondary market often exists, selling early might result in selling at a discount.

- Market Risk: In yield enhancement products, if the barrier is breached (e.g., the stock drops by 40%), you may lose capital.

- Complexity: The terms can be complicated. For those who prefer more liquid, transparent trading options without lock-in periods or complex barriers, exchange-traded futures and options might be a more suitable alternative.

Navigate Risks with Confidence

Expert guidance to help you choose the right issuer with confidence.

Who Should Invest in Structured Products?

Structured products are generally best suited for Sophisticated or Professional Investors who have a clear view of the market and want to express it precisely.

- The “Range-Bound” Investor: If you think the market will stay flat, a standard stock purchase won’t make money. A structured note can pay a coupon even in a flat market.

- The “Nervous Bull”: If you think the market will go up but fear a crash, a capital-protected note allows you to sleep well at night while still staying invested.

- The Diversifier: Investors looking to access niche markets—such as specific currency pairs or foreign sectors—can do so easily via a note. However, active traders who prefer short-term speculation on currency movements rather than holding long-term notes may find our Spot FX & CFD trading services offer the necessary liquidity and speed.

Conclusion

Structured products offer a powerful toolkit for bridging the gap between standard equity investing and fixed income safety. They allow you to customize your investment journey, offering defined returns and tailored protection levels that off-the-shelf products cannot match. However, they require a nuanced understanding of derivatives and credit risk.

At Phillip Capital DIFC, we leverage our global network to source competitive structured notes from top-tier investment banks, ensuring our clients receive transparent pricing and best-in-class execution. Whether you are seeking to protect your capital or enhance your portfolio’s yield, understanding the mechanics of these instruments is the first step toward smarter investing.

Disclaimer:

Trading foreign exchange and/or contracts for difference on margin carries a high level of risk, and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. The content of the Website must not be construed as personal advice. For retail, professional and eligible counterparty clients. Before deciding to trade any products offered by PhillipCapital (DIFC) Private Limited you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Rolling Spot Contracts and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of our retail client accounts lose money while trading with us. You should consider whether you understand how Rolling Spot Contracts and CFDs work, and whether you can afford to take the high risk of losing your money.

Contrarian Investing /Dip Buying

Contrarian Investing / Dip buying Mastering the Art of Contrarian...

Read MorePartial Capital Protection

Partial Capital Protection Partial Capital Protection: The Strategic Bridge Between...

Read MoreFutures Pricing And Valuation

Futures Pricing And Valuation Table of Contents What is the...

Read MoreThe Inverse Relationship Between Bond Prices and Yields

The Inverse Relationship Between Bond Prices and Yields Table of...

Read MoreGrowth at Reasonable Price (GARP)

Growth at Reasonable Price (GARP) Mastering Growth at Reasonable Price...

Read MoreCapital Protection Structures

Capital Protection Structures Strategic Wealth Preservation: A Comprehensive Guide to...

Read Moreunderstanding dividend yield investment guide

Dividend Yield The Strategic Guide to Dividend Yield: Maximizing Passive...

Read MoreCurrent Yield vs Yield to Maturity

Understanding Current Yield vs. Yield to Maturity Understanding Current Yield...

Read MoreHow Futures Exchanges Work

How Futures Exchanges Work Understanding the Mechanics of Global Futures...

Read MoreBond Yield Vs Interest Rates

Bond Yield Vs Interest Rates Understanding the Relationship Between Bond...

Read MoreUnderstanding Exchange Rates

Understanding Exchange Rates In an increasingly interconnected global economy, the...

Read MoreBond Yield to Maturity (YTM)

Bond Yield to Maturity (YTM) Understanding Bond Yield to Maturity...

Read MoreUnderstanding Futures Contracts

Understanding Futures Contracts Understanding Futures Contracts in Global Markets In...

Read MoreCalculating Bond Price And Yield

Calculating Bond Price And Yield Understanding Bond Valuation: A Comprehensive...

Read MoreEnterprise Value And Ev/Ebitda

Enterprise Value And EV/EBITDA Enterprise Value and EV/EBITDA: A Comprehensive...

Read MorePrice-to-Sales Ratio (P/S)

Price-to-Sales Ratio (P/S) Understanding the Price-to-Sales Ratio (P/S) in Modern...

Read MorePrice-to-Book Ratio

Price-to-Book Ratio (P/B) The Essential Guide for Identifying Undervalued Stocks...

Read MoreBond Pricing Fundamentals

Bond Pricing Fundamentals A Guide for Investors Table of Contents...

Read MorePrice-to-Earnings Ratio (P/E)

Price-to-Earnings Ratio (P/E) Table of Contents What is the Price-to-Earnings...

Read MoreBase Currency vs Quote Currency

Base Currency vs Quote Currency Table of Contents What is...

Read MoreShort-Term, Intermediate, and Long-Term Bonds

Bond Maturities Short-Term, Intermediate, and Long-Term Bonds Table of Contents...

Read MoreSector Rotation Strategy

Sector Rotation A Strategic Guide to Investing Through Economic Cycles...

Read More